Candlestick Chart Patterns for trend reversals

This post covers some important single candle Candlestick Chart Patterns that are important to identify trend reversals.

Hammer Candlestick Pattern

A hammer is a kind of bullish reversal candlestick pattern, consists of only one candle, and appears after a downtrend. The candle is similar to a hammer, simply because it has a long lower wick and a short body at the top of the candlestick with almost no upper wick.

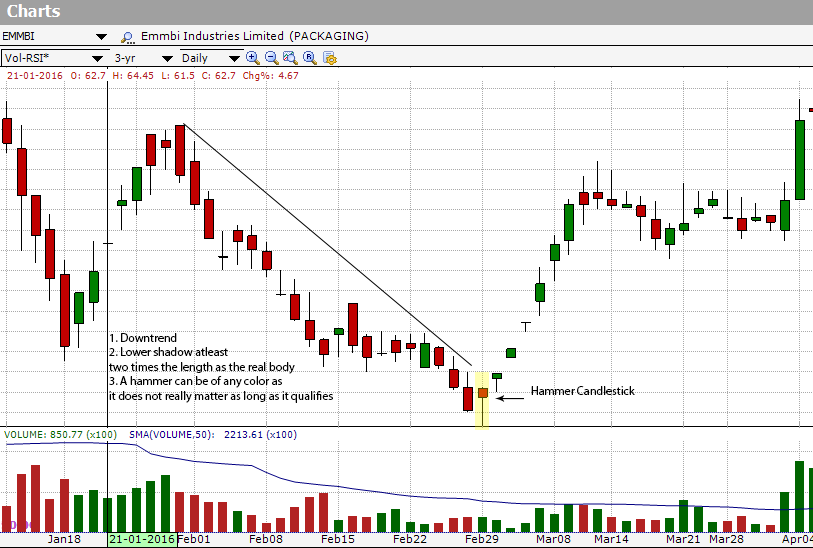

The Hammer pattern is created when the open, high, and close are such that the real body is small. Also, you can find a long lower shadow, 2 times the length as the real body. It should look just like a capital ‘T’. This signifies the possibility of a hammer candle. The real body can be black (red in picture above) or white (green in picture above).

When you notice the hammer form in a downtrend, this is an indication of high potential reversal in the market as the long lower wick signifies a period of trading in which the sellers were initially in charge but yet the buyers were capable to reverse that control and drive prices back up to close near the high for the day, as a consequence the short body at the top of the candle. After noticing this chart pattern form in the market the majority of traders will watch for the next period to open higher than the close of the previous period to make sure the buyers are actually in control.

How does a Hammer Pattern Form?

Hammer candlestick is formed when a stock moves notably lower than the opening price but rallies in the day to close above or close to the opening price. The larger the lower shadow, the more significant the candle becomes.

Hammer can be found on any specific time frame candlestick chart. The larger the time frame chart, the more comprehensive the hammer candlestick is going to be, due to the more participants involved.

The below chart of Emmbi Industries Ltd (EMMBI) shows a Hammer reversal pattern after downtrend.

The Hammer is an extremely helpful candlestick pattern to help traders visually see where support and demand is located. After a downtrend, the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered.

Inverted Hammer Candlestick Pattern

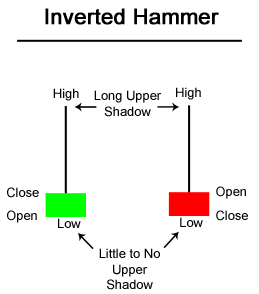

The inverted hammer is a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal. The inverted hammer looks like an upside-down version of the hammer candlestick pattern, and when it appears in an uptrend is called a shooting star.

The pattern is made up of a candle with a small lower body and a long upper wick which is at least two times as large as the short lower body. The body of the candle should be at the low end of the trading range and there should be little or no lower wick in the candle.

The long upper wick of the candlestick pattern indicates that the buyers drove prices up at some point during the period in which the candle was formed, but encountered selling pressure which drove prices back down to close near to where they opened. When encountering an inverted hammer, traders often check for a higher open and close on the next period to validate it as a bullish signal.

Hanging Man Candlestick Pattern

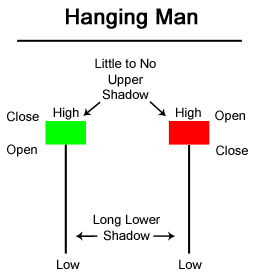

The bearish version of the Hammer is the Hanging Man formation. A hanging man is a type of bearish reversal pattern, made up of just one candle, found in an uptrend and can act as a warning of a potential reversal downward.

The Hanging Man formation, similar to the Hammer, is formed when the open, high, and close are such that the real body is small. Additionally, there is a long lower shadow, which should be two times greater than the length of the real body. The Hanging Man patterns indicates trend weakness, and indicates a bearish reversal. Hanging man patterns can be more easily observed in intraday charts than daily charts. If this pattern is found at the end of a downtrend, it is generally known as a “hammer“.

A hanging man can be of any color and it does not actually make a difference as long as it qualifies ‘the shadow to real body’ ratio. In order for a candle to be a valid hanging man the majority of traders claim the lower wick needs to be 2 times greater than the size of the body portion of the candle, and the body of the candle needs to be at the upper end of the trading range. Bearish Hanging Man candles form quite often so you want to use other indicators to verify potential moves.

Hammer vs Hanging Man

A hanging man candle is similar to the “hammer” candle in its appearance. Their difference can be found in what type of trend the candle follows. The color of the candlestick in either scenario is of no consequence.

If the pattern appears in a chart with an upward trend implying a bearish reversal, it is called the hanging man. If it appears in a downward trend indicating a bullish reversal, it is a hammer.

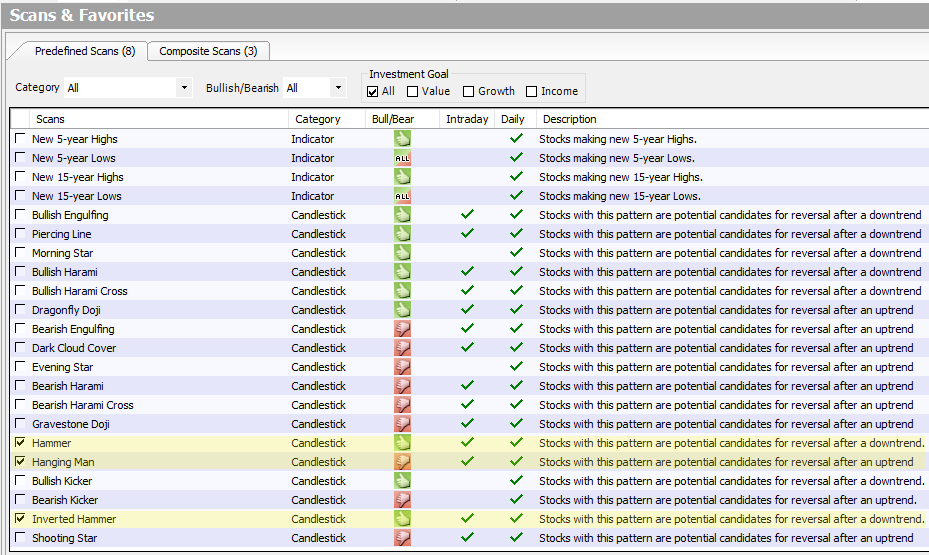

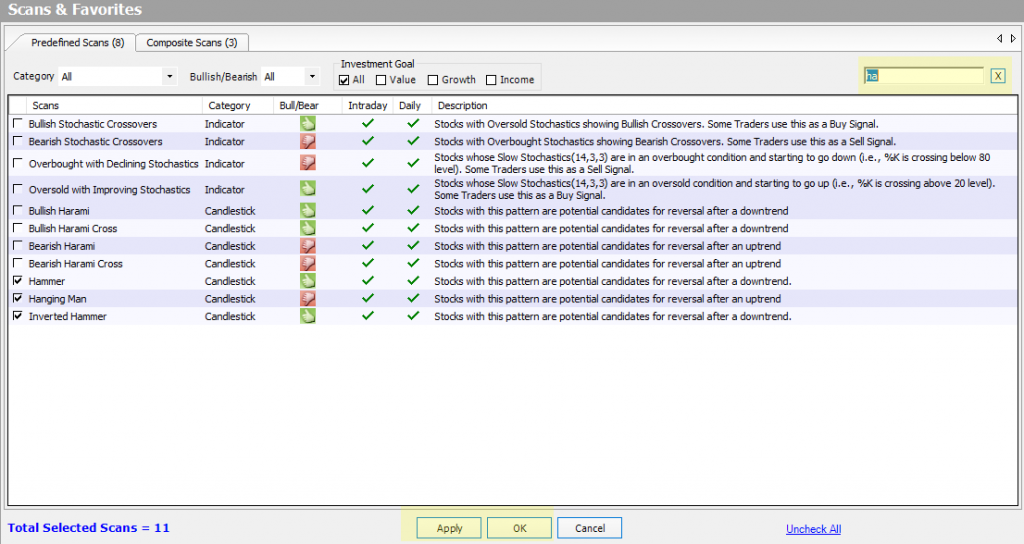

Adding Scans In charts

In Investar, we have added user-friendly scans to help you find Hammer /Inverted Hammer/Hanging Man stocks. All you have to do is to select the following scans from Predefined scans list: “Hammer” or “Inverted Hammer” or “Hanging Man”

Simply follow the steps to add scans in the charts:

(1) Click on Managed Scan button and predefined list of scans will appear, (2) scroll down to select Hammer/Inverted Hammer or Hanging man scans or simple type in search box and select the scans and (3) click apply/Ok

Want to scan stocks with Hammer, Hanging Man and Inverted Hammer?

Click on the button below to download a Free 7-day trial of Investar:

Good explanation