In the world of options trading, the short straddle strategy is a popular choice among traders looking to capitalize on low volatility periods. This strategy involves selling both a call and a put option with the same strike price and expiration date. While it offers potential for profit, it also comes with significant risk. In this blog post, we’ll delve into the intricacies of the short straddle options strategy, exploring how it works, its benefits, and its risks.

What is a Short Straddle Options Strategy?

A short straddle options strategy involves selling a call option and a put option at the same strike price and expiration date. This strategy is typically used when a trader expects the underlying asset to experience minimal price movement. The goal is to profit from the premiums received from selling the options, as long as the asset’s price remains relatively stable.

Understanding Short Straddles

To understand a short straddle, it’s important to grasp the concept of market neutrality. Here’s how it works:

- Market Neutrality: This strategy doesn’t depend on whether the market goes up or down. Instead, it benefits if the underlying asset stays relatively stable.

Steps to Create a Short Straddle:

- Sell a Call Option: Sell a call option with a strike price at the current market price of the asset.

- Sell a Put Option: Simultaneously, sell a put option with the same strike price and expiration date.

The goal is to collect premiums from both options, hoping the underlying asset’s price remains close to the strike price until expiration.

Example of a Short Straddle

Let’s say Stock HEROMOTOCO is currently trading at ₹5400. You sell a call option and a put option, both with a strike price of ₹ 5400, and each with a premium of ₹ 178 & ₹ 182.

- Total Premium Collected: ₹178 (call) + ₹182 (put) = ₹ 360

Scenario Analysis:

- Stock Stays at ₹5400:

- Both the call and put options expire worthless.

- Profit: You keep the ₹360 premium.

- Stock Rises to ₹5700:

- The call option is exercised.

- You sell the stock at ₹5400 (strike price) but the market price is ₹5700.

- Loss on Call Option: ₹5700 – ₹5400 = ₹300

- Net Result: ₹360 (premium collected) – ₹300 (loss) = ₹60 (net profit)

- Stock Falls to ₹5100:

- The put option is exercised.

- You buy the stock at ₹5400 (strike price) but the market price is ₹5100.

- Loss on Put Option: ₹5400 – ₹5100 = ₹300

- Net Result: ₹360 (premium collected) – ₹300 (loss) = ₹60 (net profit)

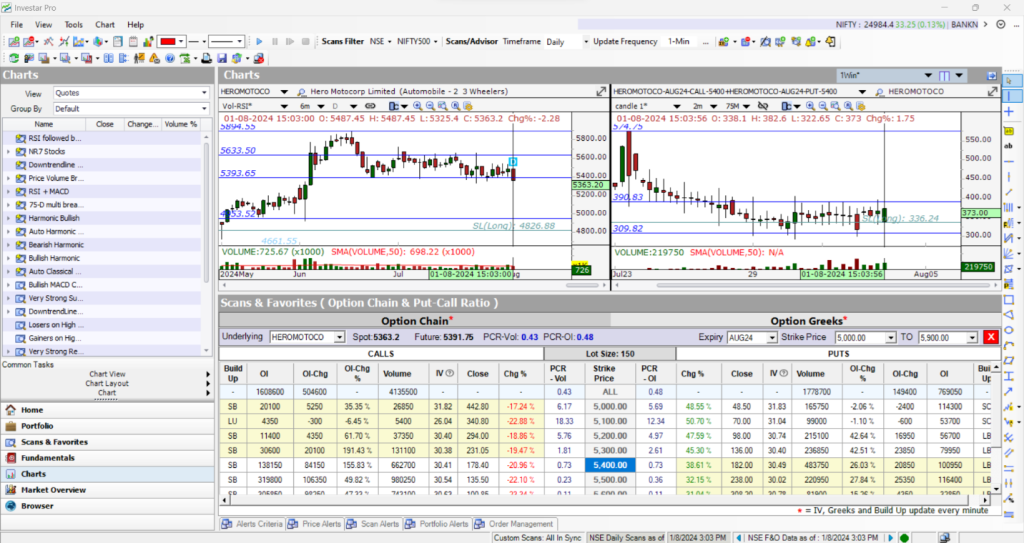

Investar Software empowers you to effortlessly visualize and analyze option trading strategies. By combining option chains, option Greeks, and interactive charts, you can gain deep insights into option price behavior. Understand how factors like time decay (Theta), volatility, and underlying stock price movement (Delta, Gamma) impact option values.

Investar’s flexible layout options allow you to simultaneously view call & put option chart and the underlying stock’s price chart for comprehensive analysis.

Follow these steps:

- Click on the Charts button in the bottom left to navigate to Chart Pane and select the 2-Chart Layout.

- Make sure the “Synchronize View” is checked.

- Enter a STOCK or INDEX symbol on the left and the SPREAD symbol on the right by combining 1 call option & 1 put option with a ‘+’sign as shown below.

- Also, if you want to see Option chain with 2 charts, right click on the chart, then click on the Option Chain button as shown below.

- You can see the option chain with charts as shown below.

- It will facilitate your trading. Numerous incredible features will be readily available to you after installing the Investar software.

Benefits of Short Straddle

The short straddle offers several advantages:

- Premium Collection: You earn premiums from both the call and put options.

- Market Neutrality: This strategy can be profitable in sideways or low-volatility markets.

- Flexibility: Can be adjusted or exited before expiration if market conditions change.

Drawbacks of Short Straddle

However, like any strategy, it comes with risks:

- Unlimited Risk: Potential losses are theoretically unlimited if the market moves significantly in either direction.

- Margin Requirements: Typically requires a significant margin deposit due to the high risk.

- Volatility Risk: Sudden spikes in volatility can lead to large losses.

Conclusion

The Short Straddle Options Strategy can be a powerful tool for traders expecting minimal price movement in the underlying asset. While it offers the potential for premium collection and market neutrality, it also carries significant risks, including unlimited potential losses. As always, it’s crucial to thoroughly understand the strategy and carefully consider the risks before diving in.