Now you can create your own custom scans with Investar. Custom Screener is a tool to help you scan stocks broken out of various technical levels or satisfying certain indicator critera that you’ve customized and built during your experience with stock markets & technical analysis. Investar’s Custom Screener encompasses all the flexibility requested by our users to provide custom, accurate & fast stock scans as well as retaining the auto-updating nature of our pre-defined scans that users are so much used to. Our motto is to help the trader/investor to find new stock ideas in the market whether you are an intraday trader, short-term swing trader or long-term investor.

Check out for this Youtube Custom Screener Video where you will learn how to create custom queries based on a combination of indicators, candlestick patterns, and Auto-SR support/resistance level breakouts.

A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. For example, users are able to screen for stocks by data including price, dividend yield, and 52-week price change percentage, or having RSI values greater than 70 or stocks closing above their open price and many more…

Let’s see how quick and easy it is to find some great performing stocks!

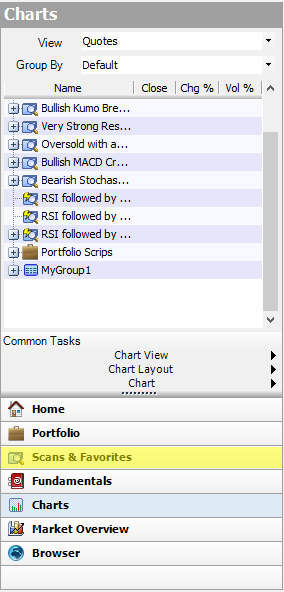

To create a Custom Scan, click on the “Scans & Favorites” button in the navigation pane. Then click on the scans menu and click on create custom scans.

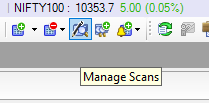

Or Select Manage Scans from the Standard Toolbar on top as follows:

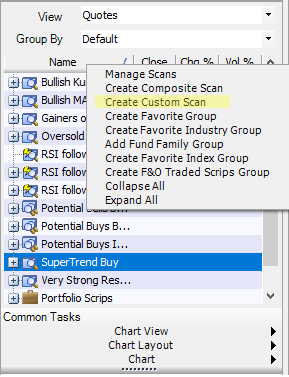

Or you can also Right-click on Name Tab and select option “Create Custom Scans”

The first thing to do is give your Scan a name so you can find it later once it’s saved.

Write the name and description of your Custom Scan in the Name and Description Boxes respectively.

Adding your first Query in 3 Steps

Step 1:

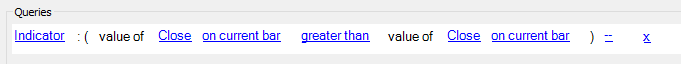

In the interface, you’ll see a basic screen with default example of custom scans. The blue colored texts composed of fields allowing you to choose a ratio or metric and compare it with a value.

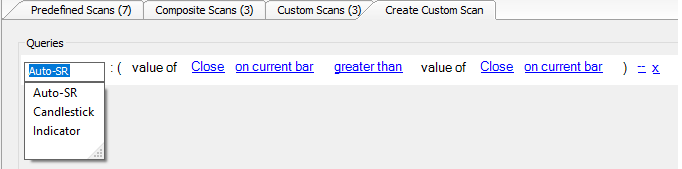

If you click on the first field “Indicator” – you will see an Auto-suggestion menu containing Scan Type. These scan type will help you to decide the scan type on what you want to make a query.

Currently, Investar supports three Main type of Scans Types

- Auto S/R

- CandleStick

- Indicator

Once you’ve decided the scan type you are after, either click or press <enter> to select it. Let’s select Indicator, for example.

Step 2:

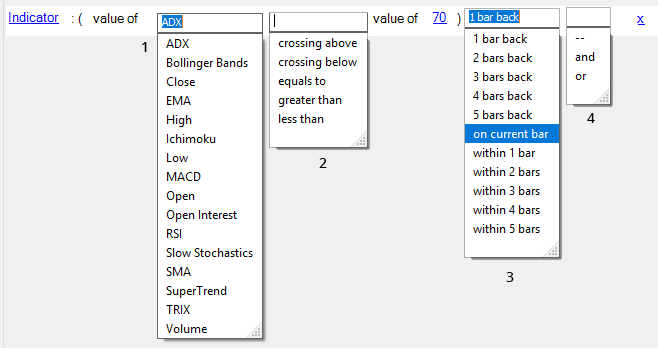

The next step is to define how you want your scan to work. Scans are made up of multiple filters, which can be added by clicking on the blue colored text. This means deciding whether the Indicator ADX or RSI or volume or any other value on which bar should be ‘crossing above’, ‘crossing below,’ ‘greater than’, ‘less than’ or ‘equal to’ a specific value of which Indicator’s bar.

According to your selection of scan type you will be shown attributes related to the Open, High, Low, Close, etc. As you can see in above image we have selected Indicator Scan type so we will be shown indicators like RSI, MACD, ADX, SMA, EMA.. etc and define various criteria against them to filter stocks.

Most of the indicators require a parameter to be specified for their computations, Investar defaults the parameter when you add them(inside brackets), you can also change the parameter of any of the indicators.

Once you have added a “Stock Attribute”/”Indicator” you’d want to perform certain operations on them (eg compare them), operations bind indicators to your custom criteria.

Often you want to filter stocks based on certain breakouts, which could be a result of an indicator closing below a value (or another indicator) yesterday but closing above it today(signifying a crossover). To add more than a single filter you can simply select a query qualifier operator in the end as shown in above figure.

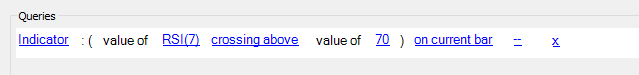

Let’s choose RSI 7 crossing above the value of 70 on current bar. Then our query will look something like this:

Note:

- Within bar means the bar including current bar, for example: if you have chosen “within 2 bars” as your “crossing above” criteria then it means that the crossover condition will check total 3 bars including current bar and previous 2 bars of current bar and give you the crossovers that have happened in any of the 3 bars including the current bar.

- Bar Back means the bar excluding current bar, for example: if you have chosen “2 bars back” as your “crossing above” condition then your condition will apply to the bar 2 bars back with respect to the current bar.

Step 3

Finally, to complete the scan, we select whether the query is a Bullish type or Bearish type. This defines whether the Custom-Scan based signal will appear as a Buy condition or Sell condition in the Buy/Sell signal dialog box. Lastly, Click the ‘Save‘ button to send your scan to the Scan Engine.

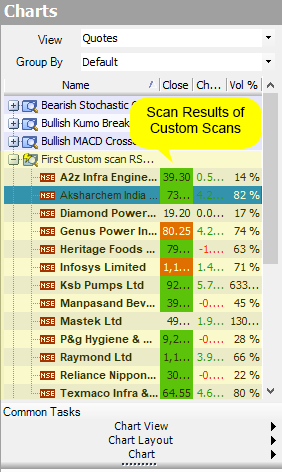

After clicking on Apply button you can see the selected custom scan appear in the navigation pane.

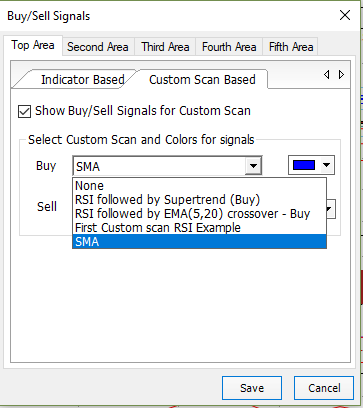

To see Buy/Sell signals for Custom screener all you have to do is Select Buy/Sell Signal from toolbar menu and select Custom Scan Based Tab.

Now click on the Save button.

The blue arrow indicates the Buy signals for custom Scans. You can also change the color of Buy/Sell signals.

We hope this post has given you some new ideas on creating and testing your own customs scans.

Check out for Custom Scan Video:

The levels of ADX are not available.

Ex- ADX crossing over 30. (These levels should be available, if not, the authenticity of the ADX indicator is moot. Could you please tell me when it shall be available.

Thanks for the feedback, we will make sure it is incorporated in a future update.

Dear Sir,

Can you please add a scan on PSAR ,Thanks

Thanks for the feedback. We will definitely consider it for the future.

Sir,

Can you add some custom scans which will be useful for us to understand and experiment .It will be greatly usefull.

Sir, I am a Investar Beta user,

I want to create a custom scan according to following criteria, I try but unable to input, Pl. help me how can I input the following criteria into the custom scan on INVESTER BETA :

SMA (Close-20) of 5th. bar/candle back from current bar/candle – Say define – P

SMA (Close-20) of 4th. bar/candle back from current bar/candle – Say define – Q

SMA (Close-20) of 3rd. bar/candle back from current bar/candle – Say define – R

SMA (Close-20) of 2nd. bar/candle back from current bar/candle – Say define – S

SMA (Close-20) of 1st. bar/candle back from current bar/candle – Say define – T

SMA (Close-20) of ——————————– current bar/candle – Say define – U

Now required custom scan:

(P) greater than (Q) greater than (R) greater than (S) greater than (T)

and

(U) greater than (T)

and

(U) greater than (S)

Can we use multiple time frames????

Yes. You can use multiple timeframes.