On 8th Nov, 2016, PM Narendra Modi announced the cancellation of Rs 500 and Rs 1000 notes (aka demonetization) which resulted in 86% of the circulated money being removed from the economy overnight. This was primarily done to curb the black money, make all the counterfeit currency worthless and attack terrorism at its roots.

To understand the impact on the stock market, let’s first understand how significant a move this is. In the past many countries have attempted demonetization, some successfully and some unsuccessfully, but all of them were done when their economies were having major problems like hyper-inflation in Germany in the 1920s. This is the first time that a perfectly healthy economy has attempted it and that too to target black money. Because this is a first, there are varied opinions amongst economists on what the impact will be in the future.

The immediate impact of removing so much money from circulation is of course the impact it can have on several sectors that are driven by the black economy like real estate, construction etc, but more so also the sectors that are more driven by cash, because they are the first that are affected when so much money is suddenly removed from circulation.

Here is how the various sectors have been impacted after the demonetization move and what we think could happen in the future:

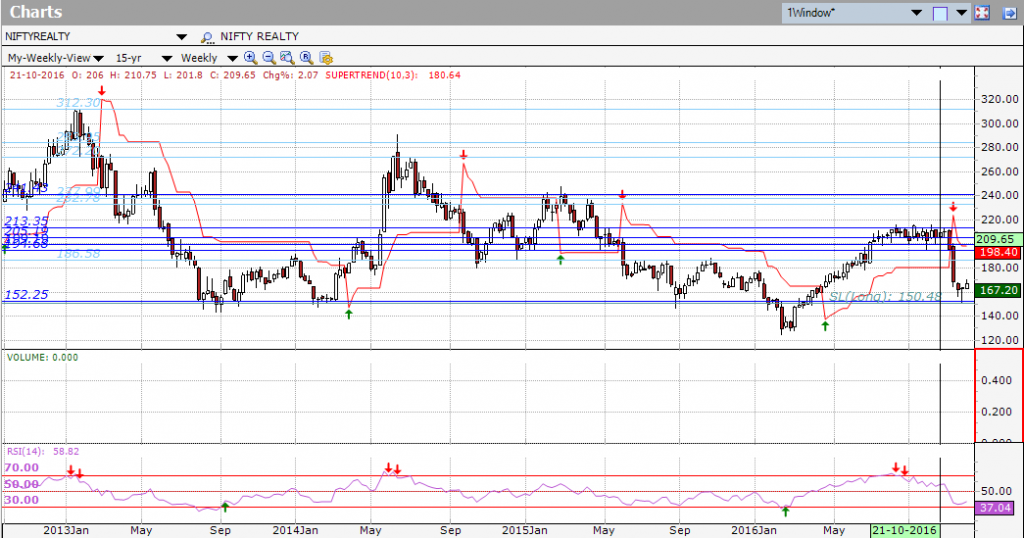

Real Estate

Since Real Estate is driven by the black economy, this was the sector that was probably the worst hit of all the sectors. The Nifty Realty index gapped down after the day of the demonetization move and corrected -25% ( as indicated in the chart below, the NIFTYREALTY bounced of the Auto-SR very strong support of 152.5 on a weekly chart) before recovering a bit. It is still down almost -16% from 8th Nov.

Since many real estate properties have a big black money component, they are expected to go through at least a 20-30% correction, and hence for the foreseeable 2 quarters at least, chances are that this sector will probably go lower before it starts to improve.

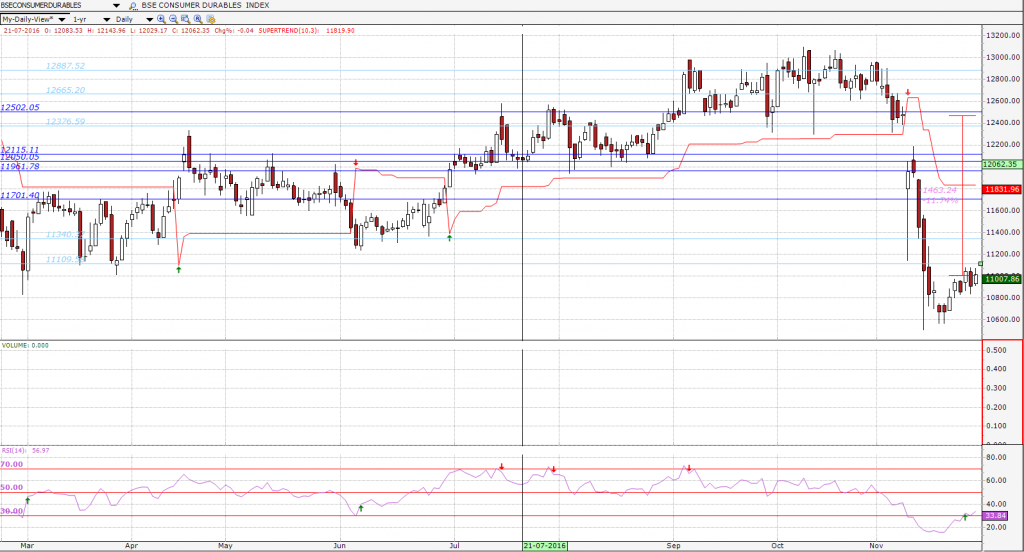

Consumer Durables

This sector is primarily driven by cash and hence has also been hit hard. It is down by almost 11.7% since the demonetization announcement.

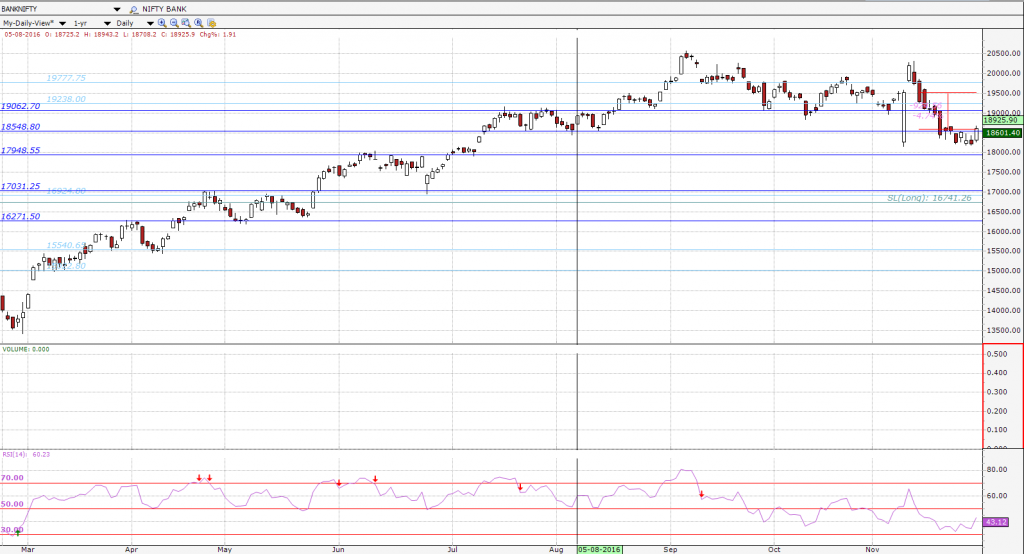

Banking

The Banking sector took an immediate hit the day after the announcement but recovered on Nov 10th. But, it has been subsequently correcting as it is still grappling with trying to replenish the cash in the economy. However, this is one sector which is expected to benefit in the long term because a lot of the black money will be deposited in bank accounts and the excess funds in the banking system will also help address the non-performing assets (NPA) problem that many of the banks are facing due to bad loans. Due to these NPA problems, a lot of the infrastructure funding etc has also been affected and hopefully, that should also be addressed when the current cash crunch is reduced and economy claws back to normalcy.

Infrastructure

The infrastructure sector is driven by massive investments from government as well as loans from banks. One of the healthy effects of demonetization is to increase the liquidity in the banking system as well as increase the funds that the government has for spending on items like infrastructure, welfare etc, so the Infrastructure is an obvious beneficiary of that. The fact that the NIFTYINFRA index has not been affected much (as is confirmed by the fact that it is up marginally since Nov 8th in the chart below):

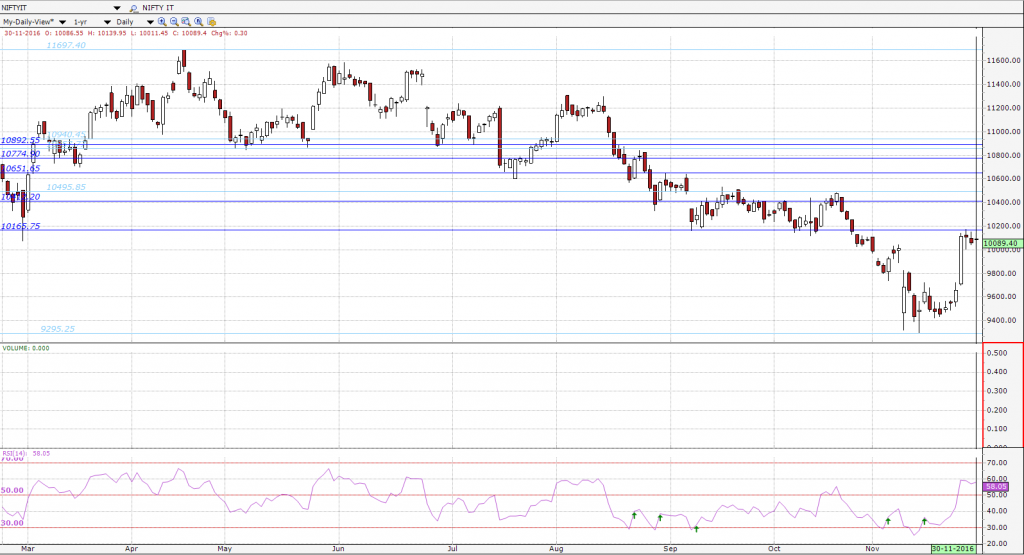

Information Technology

The IT sector has been largely unaffected by the demonetization as it is export oriented and hence relatively better positioned to handle shocks in the Indian economy. Moreover it is probably also largely a cashless sector and hence also not affected due to the cash being taken out of the economy. The NIFTYIT chart below shows that the IT sector is actually doing better than from what it was on Nov 8th.

In conclusion, we can probably summarize the effect of demonetization on the overall economy as follows:

- In the short term, GDP will be down for at least a 1-2 quarters before recovering.

- A lot of black money will be converted to white and be deposited into the banks which will in turn help in the NPA problem that banks are facing.

- In the longer term, reducing of black money economy in the future should bring more people in the tax net and hence lower taxes as well as interest rates which will bode well for the overall economy.

Although this was what is called a surgical strike on black money and will have immediate impact on the existing black money, most economists agree though, that this move is not sufficient and several other reforms like tax reforms, real estate reforms etc need to be undertaken to curb the black money generation in the future.

nice i like concept

nice