The year 2016, without a doubt, has been a roller-coaster ride of many surprises. The unexpected Rexit, Brexit result in June, Donald Trump’s unexpected triumph in the US Presidential election, a surgical strike on Pakistan and the most notable of them all, obviously, was the government’s decision towards the end of the year to demonetize Rs 500 and Rs 1 ,000 currency notes.

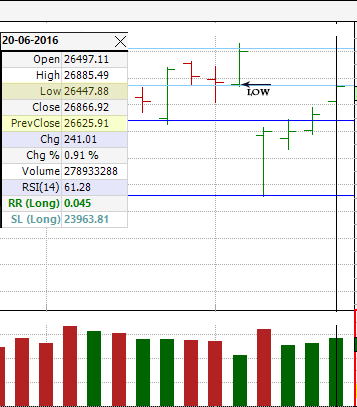

In an unexpected move on June 18, RBI governor Raghuram Rajan rattled everybody by declaring he would step down as the Governor of the Reserve Bank of India at the end of his three-year term. As a reaction to Rajan’s resignation, a considerable number of economists and traders were disappointed, the Sensex dropped approximately 178 points in early trade, but ended 241 points higher at 26,866.92. Though markets opened with considerable cut, they restored afterwards in the day.

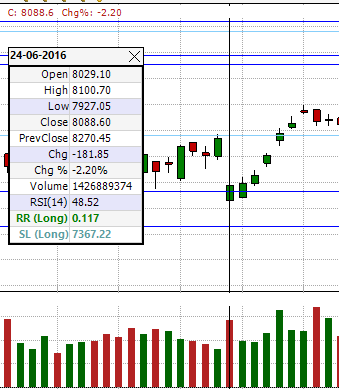

Another shocker, a much bigger event, hit the market as Britain voted to exit the European Union (EU), which again —spooked the markets. The Sensex opened lower by 634 points and tanked 1,091 points in intra-day trade, but recovered slightly to close. The Nifty closed at 8,089, slipping 182 points.

The other shocking event was the election of Donald Trump by beating Democrat Hillary Clinton in the US presidential election. The day after the demonetization move was announced and Trump won the US presidency, the BSE Sensex opened with a massive loss of 1070 points but recovered later. Although it is hard to isolate the drop in the markets to one of the events, demonetization had a bigger impact on the Indian economy, and hence that news probably had a bigger impact on the market.

As 2016 comes to an end, demonetization happens to be the boldest reform and will have the most lasting impact on the stock market. Since then, the Nifty has lost over 476 points to trade merely a tad above the 8 ,000-mark, while the Sensex has a drop over 1,070 points to hover around the 26,000 level.