Introduction

The world of options trading can seem daunting, but mastering strategies like the long straddle can open doors to potentially significant profits. The long straddle options strategy is a versatile tool that allows traders to capitalize on volatility without needing to predict the market’s direction. In this guide, we’ll delve into the ins and outs of the long straddle, helping you understand how it works, when to use it, and how to maximize its benefits.

What is a Long Straddle?

A long straddle involves simultaneously buying a call option and a put option with the same strike price and expiration date. This strategy is designed to profit from significant price movements in either direction, leveraging market volatility.

Key Characteristics

• Neutral Outlook: Ideal when you’re unsure about the market’s direction.

• High Volatility: Best used in markets where significant price swings are expected.

How It Works

By purchasing both a call and a put option, you position yourself to gain from any substantial movement in the underlying asset’s price. If the price rises, the call option gains value. If the price falls, the put option gains value. The goal is to have the gains from one option exceed the combined cost of both options.

Components of a Long Straddle

Buying a Call Option

This part of the strategy allows you to benefit from upward price movements. If the asset’s price rises above the strike price plus the premium paid, the call option becomes profitable.

Buying a Put Option

This component lets you profit from downward price movements. If the asset’s price falls below the strike price minus the premium paid, the put option gains value.

When to Use a Long Straddle

Ideal Market Conditions

A long straddle is most effective in markets with high volatility or when you expect a significant price change due to events like earnings reports, economic data releases, or political events.

Examples of Market Scenarios

- Earnings Announcements: Companies often experience significant price movements after announcing quarterly results.

- Economic Data Releases: Indicators like GDP growth rates, employment figures, and inflation reports can cause sharp market reactions.

Long Straddle Example

Let’s say Stock RELIANCE is currently trading at ₹ 3060:

- Buy a ₹ 3060 Call for ₹83 premium.

- Buy a ₹ 3060 Put for ₹72 premium.

Your net debit ₹83 + ₹72 = ₹155 per share. Since options contracts are for 250 shares, your total net debit is ₹38750.

If RELIANCE goes below (₹3060 – ₹155) ₹2905 before expiration, you will be in profit. If RELIANCE rises above (₹3060 + ₹155) ₹3215 before expiration, you will also make money.

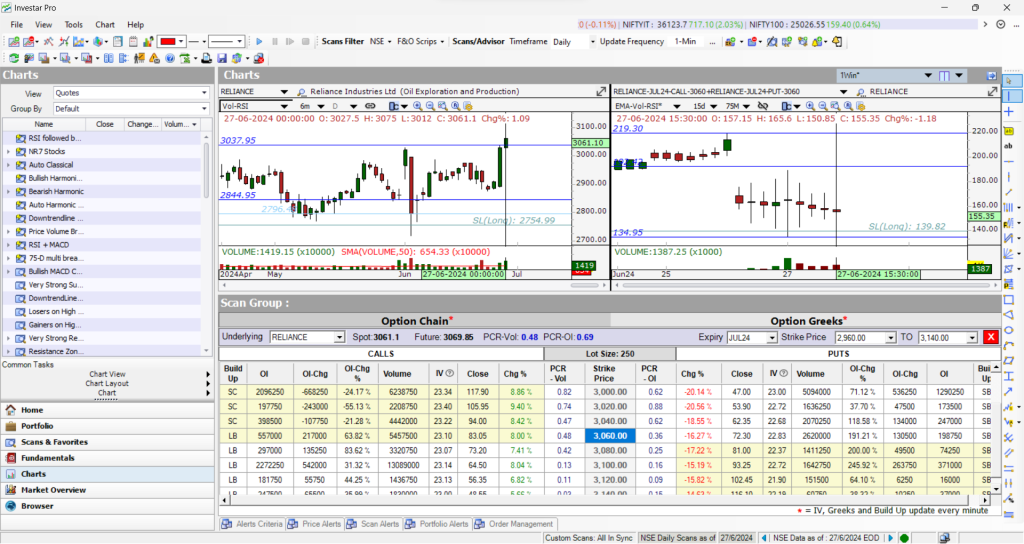

This strategy is simply plottable in Investar Software. You can utilize the Option Chain and Option Greeks at the same time in addition to the charts. Greeks such as Delta, Gamma, and Theta can help you understand how the option price will respond to variations in time decay, volatility, and the price of the underlying stock.

Also, you can use multiple chart layout as follow:

- Click on the Charts button in the bottom left to navigate to Chart Pane and select the 2-Chart Layout.

- Make sure the “Synchronize View” is checked.

- Enter a CALL symbol on the left and the SPREAD symbol on the right by combining 2 call options with a ‘+‘ sign as shown below.

- Also, if you want to see Option chain with 2 charts, right click on the chart, then click on the Option Chain button as shown below.

- You can see the option chain with charts as shown below.

- It will facilitate your trading. Numerous incredible features will be readily available to you after installing the Investar software.

Benefits of the Long Straddle Strategy

Profit Potential

The primary allure of the long straddle is its unlimited profit potential. Since you’re positioned to profit from large moves in either direction, significant market swings can lead to substantial gains.

Limited Risk

Your maximum loss is limited to the total premiums paid for the call and put options. This predefined risk makes the long straddle an attractive strategy for traders looking to hedge against uncertainty.

Risks and Drawbacks

Cost Considerations

Long straddles can be expensive because they involve purchasing two options. The premiums can add up, and if the market doesn’t move significantly, you could lose the entire investment.

Time Decay

Options lose value as they approach expiration. If the asset’s price doesn’t move enough to offset the premiums paid, the time decay can erode your profits.

Costly Entry

High implied volatility (IV) leading up to an anticipated price swing makes straddles expensive to enter. You’re essentially paying a premium against an unknown direction.

Volatility Fade

Even if the price moves as expected, the post-event drop in IV can significantly erode your profits. The options themselves might not move much if the price stays within your strike prices, but the declining IV eats away at their value regardless.

Setting Up a Long Straddle

Step-by-Step Guide

- Identify Volatile Stocks: Look for stocks or assets with a history of large price movements.

- Select Strike Prices: Choose strike prices close to the current market price.

- Choose Expiry Dates: Consider the timing of expected volatility events.

- Purchase Options: Buy both the call and put options simultaneously.

Choosing the Right Strike Prices and Expiry Dates

Strike prices should be close to the current market price to maximize potential gains. Expiry dates should align with the timing of anticipated volatility.

Analyzing Market Movements

Volatility and Its Impact

Volatility is the lifeblood of the long straddle strategy. Higher volatility increases the chances of significant price movements, which are essential for the strategy to succeed.

Predicting Significant Price Changes

While predicting exact price movements is challenging, keeping an eye on upcoming events and historical volatility patterns can help you identify potential opportunities.

Exit Strategies

When to Close Your Position

Close your position when one of the options has gained enough to cover the combined cost of both premiums. This usually happens when the asset’s price has moved significantly in one direction.

Adjusting Your Straddle

In some cases, you might adjust your straddle by selling one option and buying another to extend the expiration date or change the strike price, adapting to evolving market conditions.

Comparing to Other Strategies

Long Straddle vs. Long Strangle

Both strategies involve buying call and put options, but a long strangle uses different strike prices, usually out-of-the-money, making it cheaper but requiring more significant price movements to profit.

Long Straddle vs. Bull Call Spread

A bull call spread involves buying a call option and selling another at a higher strike price. This strategy is cheaper but has limited profit potential compared to the long straddle.

Conclusion

The long straddle options strategy is a powerful tool for traders looking to capitalize on market volatility. By understanding its components, benefits, risks, and when to use it, you can make informed decisions and potentially profit from significant price movements. Always stay informed, use the right tools, and avoid common pitfalls to maximize your success with this strategy.

For intraday trading whether these put and call option work?

Yes, for intraday trading it’s working.