Volatility Contraction Pattern is popularized by Mark Minervini, who is a two times US Investing Champion. Last year he won the championship with a record-beating 300+% in the year. He primarily uses VCP for his trading setups. It is a twist on the ascending triangle pattern with some variation.

It has the following characteristics:

- The Stock must be in stage 2 uptrend.

- A period of price consolidation must take place in thebase.

- Price consolidation occurs after a stock has moved up in the price, the consolidation (or correction) is a constructive chart pattern that allows the stock to digest the bullish price movement.

- Price volatility must contract through the base (from left to right).

- During this period of price consolidation the stock price will correct.

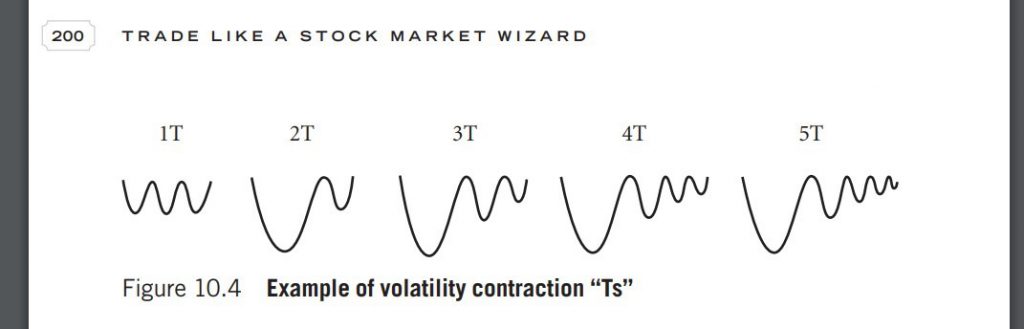

- Price must correct through a series of smaller contractions.

- Each contraction should be tighter than the last, representing the absorption of more weak holders. Ideally this pattern has between2-4 contractions.

Here is an illustration from Mark Minervini’s book, “Trade Like a Stock Market Wizard” where he describes the different possibilities of the Volatility Contraction Pattern.

Volatility Contraction Pattern in Investar

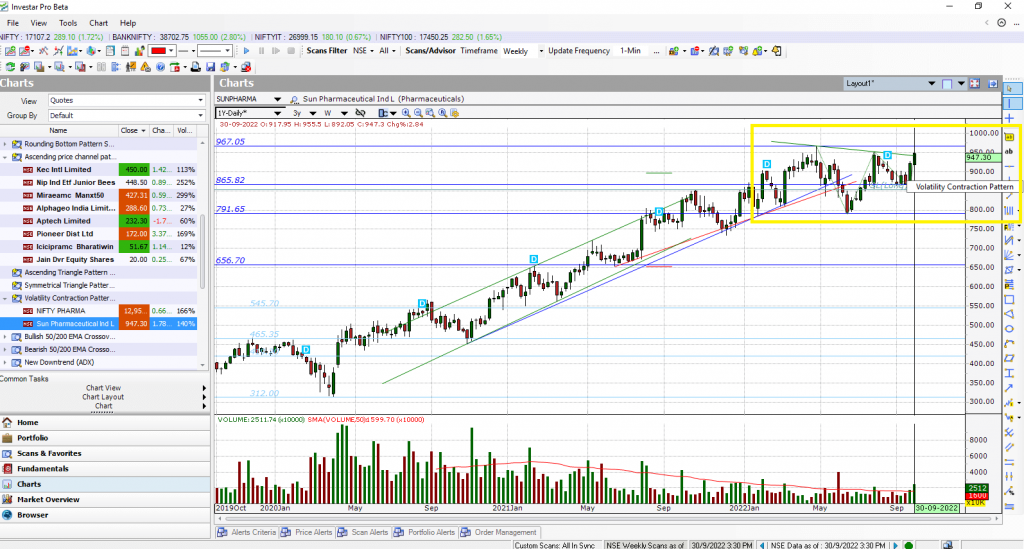

Investar now detects the Volatility Contraction Pattern automatically on visiting any chart (available exclusively to those who have the Auto-Classical Pattern addon).

Once it is enabled in Tools->Options->Auto-Classical Pattern as shown below.

You can see the VCP pattern formation in any chart (if it is getting formed). E.g. the following stock is having a VCP pattern formation:

You normally buy a stock when it breaks out of the top resistance of the VCP Pattern. You set the SL to the nearest Auto-Support/Resistance level below your buy point (if not too far) else use a money management SL.

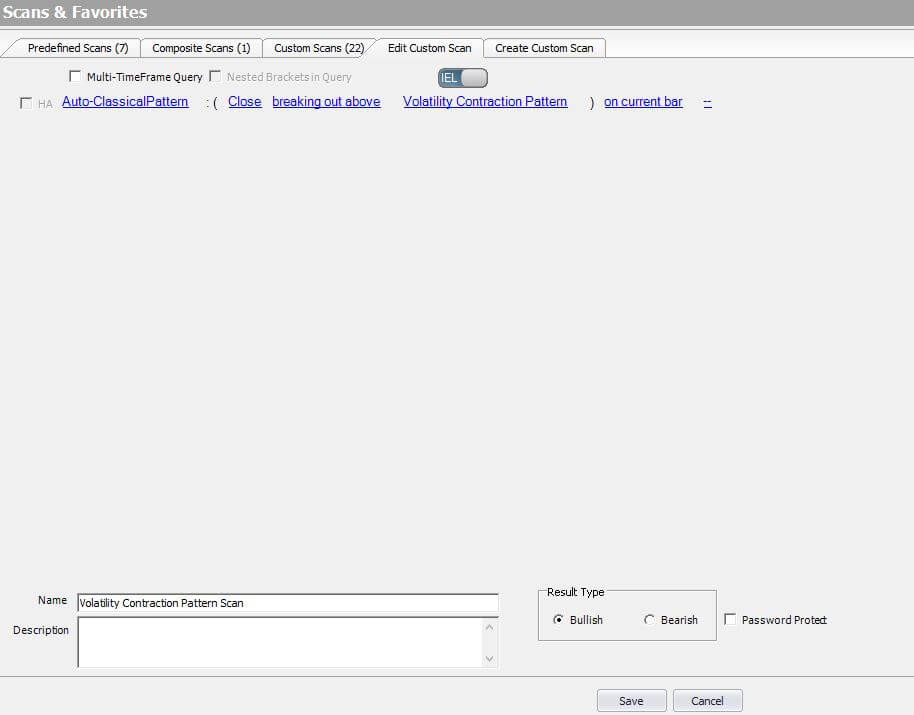

You can also scan for stocks breaking out of Volatility Contraction Pattern, by creating a Custom Scan. The Scan and the results are shown below.

We hope you find the Volatility Contraction Pattern detection useful to identify interesting breakout stocks for your trading. Do let us know your feedback in the comments below!