In a previous post, we have discussed how to use Supertrend and how it performs better than many of the trending indicators out there.

In this post, we will discuss:

- How to tune the Supertrend parameters

- How to combine it with an oscillator like RSI

Generally, as in other indicators, as you reduce the Supertrend parameters, the buy and sell signals increase and also the whipsaws due to them increase. The default parameters for Supertrend are 10,3. But, if we reduce the parameters to say 5,1.5, as shown in the chart below, the Buy and Sell signals will also increase.

Supertrend(5,1.5) (shown in top chart) gives more Buy/Sell signals (and hence more whipsaws) compared to Supertrend(10,3) (shown in bottom chart)

But, as described in the post, Choosing the right indicator parameters, one advantage of the smaller parameters is that we get more timely entries and exits. So how do you decide whether to use smaller parameters or larger parameters? One rule of thumb is that if you want faster signals then it is always better to use smaller parameters. Supertrend indicator is even more lagging than say an equivalent EMA crossover signal and because of that, sometimes your entry and exit can be late. Lowering the parameters however, also increases the whipsaws (or false signals).

Supertrend Indicator Formula with Parameters

Hence, when we lower the parameters we need to use another indicator to reduce the whipsaws and usually it ends up being an oscillator as oscillators are leading indicators. Supertrend(10,3) when combined with RSI(14) does not work so well, but if we combine RSI(7) with Supertrend(5,1.5), it gives interesting results and eliminates a lot of false signals. The general rule can be described as follows:

RSI followed by Supertrend rule:

- Buy if you get a Buy signal in RSI(7), followed by a Buy signal in Supertrend(5,1.5) within 2-3 candles.

- Sell if you get a Sell signal in RSI(7), followed by a Sell signal in Supertrend(5,1.5) within 2-3 candles.

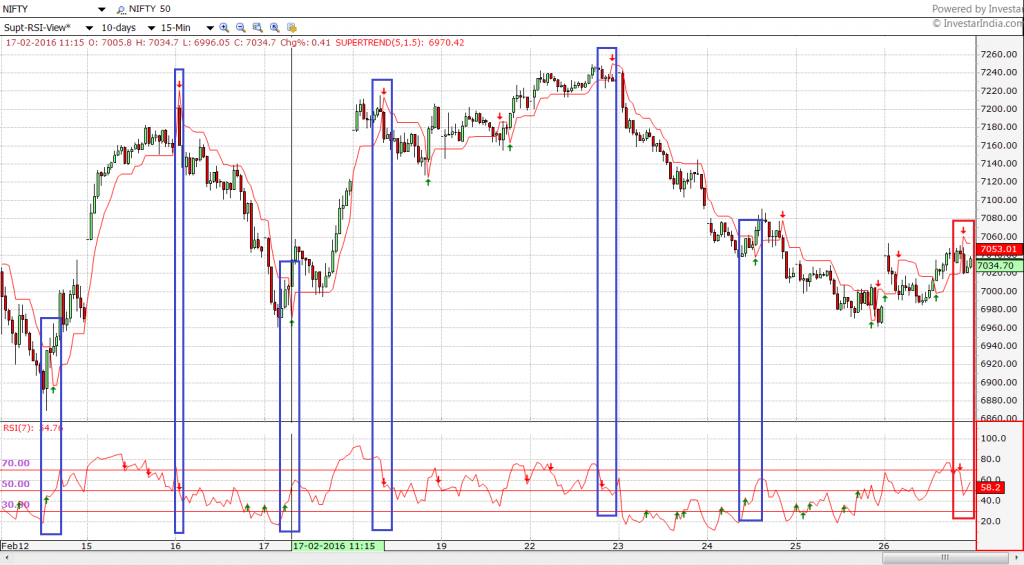

If you apply this rule to the following Nifty 15-min chart (taken as of yesterday’s close), you can see that a lot of whipsaws are eliminated. In the below screenshot, you can see that only the red rectangle indicates a false signal, while the rest of them are correct Buy and Sell signals.

RSI(7) followed by Supertrend(5,1.5) signals in Nifty 15-min chart. Rectangles indicate where the rule was true. Blue rectangles indicate true signals and red rectangles indicate false signals.

To summarize, using smaller parameters may have an advantage over using the default Supertrend parameters of 10,3 as it can give you more timely entries and exits, and using RSI(7) followed by Supertrend(5,1.5) gives us one way of eliminating the extra false signals that come as a result of lowering the Supertrend parameters.

This strategy has been discussed with practical examples using the Nifty chart, in one of the webinars we did sometime back, “Using the Supertrend Indicator“.

Want to try out this Supertrend indicator strategy?

Click on the button below to download a Free 7-day trial of Investar:

HI Team,

What is the parameters we need to select for generating the Buy\Sell signals in RSI.

Currently I am using RSI 5 with levels 30 & 70.

Thanks,

Hemanth

RSI-14 is commonly used with levels of 30 and 70. If you want to get faster Buy/Sell signals, you can go with RSI-5 or RSI-7, but remember faster signals also means more whipsaws, and you need to eliminate with a trending indicator like EMA 5-13 crossover, or maybe even a smaller parameter (you will have to test it out). See Using Multiple Indicators to reduce False Signals:

hello himanshu can u say where is exit when combining supertrend along with RSI

Exit would be when you get the confirmation when the supertrend closes above or below the price after the RSI signal.

I am using 3 supertrends : 7/3, 7/2 and 10/4 for positional trading along with other indicators. Are the parameters correct according to you? am still getting some whipsaws, and stop loss gets hit

As our “Choosing the right Indicator parameters” post suggests, there is no right or wrong indicator. In general, when you decrease the parameters for any indicator, you get faster and more signals and hence more whipsaws. This post describes a way to get the benefit of the faster signals and reducing the whipsaws with the RSI indicator.