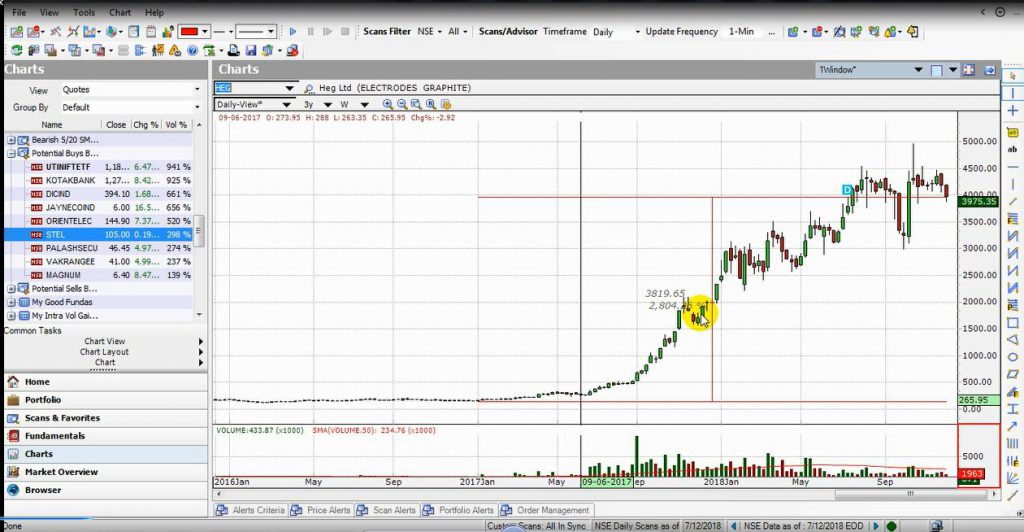

In this blog, we will find out the factors that are important for finding long-term multibaggers by using an example of HEG and Graphite India. Here’s a chart of HEG which shows a gain of 28x in 2 years.

Important Factors for finding Multibagger Stocks

First of all lets look at the factors that are important in multibagger stocks:

- Excellent Fundamentals: A stock cannot become a long-term multibagger unless it has excellent fundamentals showing great sales and eps growth numbers.

- Long Sideways Trend: Many multibaggers in the past have this characteristic that before the big guys start getting interested in them, they have a long period of sideways movement.

- Very Strong Resistance Breakout (Or Supply Zone Breakout) on High Volume: When a stock starts its upward journey, it usually does so by breaking out of a very strong resistance or supply zone on high volume.

How to find such Multibagger Stocks?

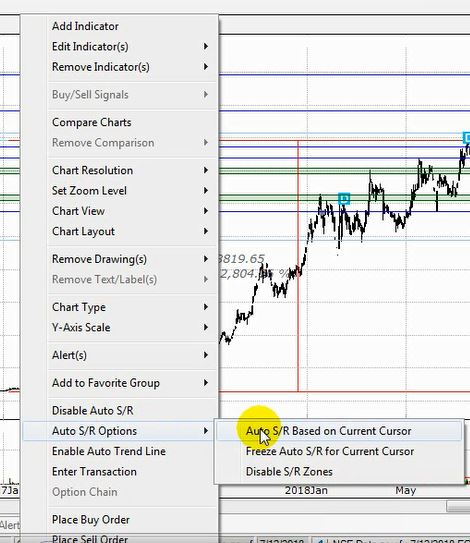

To see this, we will use a feature called “Auto-SR based on Current Cursor” to see how the chart of HEG looked at the time it started its upward move of 28x in 2 years.

Lets start by enabling Auto-Support/Resistance by right-click-ing on the chart and then selecting “Enable Auto-SR”. Then select “Auto-SR Options”. Then select “Auto-SR Based on Current Cursor” so that the Auto-SR lines are dynamically drawn based on where the current cursor is (i.e. using the past 240 bars exclusive of current cursor). This is a great way to visually backtest Auto-Support/Resistance and related features. Also ensure that “Enable Auto-SR Zones” are enabled in this menu.

If we navigate the cursor to 22/2/2017, we see that HEG did a volume breakout of not only a very strong resistance but also the Auto-Supply Zone (as shown by the red zone in the chart below).

No long-term uptrend succeeds without a prior long sideways trend. So, also make sure that there is a long sideways trend preceding the volume breakout, as shown below.

And finally, excellent fundamentals are extremely important. A long-term multibagger has exceptional growth numbers like the EPS Growth% and Sales Growth% that are exhibited by HEG (and also Graphite India) currently and also at the time of volume breakout.

To summarize, the following factors are very important to identify multibaggers:

- Very Strong Resistance Breakout (Or Supply Zone Breakout) on High Volume.

- Long Sideways Trend

- Excellent Fundamentals

You can identify such multibaggers by monitoring the “Potential Buys Breakout” scan which will help identify stocks with very strong volume breakouts. Soon, we will also be adding the support/resistance zone breakouts as a scan which will also allow finding stocks doing zone breakouts.

Check out our video on “How to find Multibaggers like HEG & Graphite India with Auto-SR based Volume Breakout Strategy” for an in-depth look into this topic :

Send some previous reccomendations.I could be interested ,if your charges are reasonable.Would like to know full information about your group and your relevant qualifications and experience in Equity analysis.

We do not give any recommendations. We give you the software and training so you can come up with your own recommendations like in the blog post above.

Midcap valuations are still high at 20 times while for smallcaps they are at 14 times on a one-year forward P/E, but this is the time to start accumulating good quality mid- and small-cap stocks. Thanks for sharing.

Identifying a multi-bagger stock requires a lot of fundamental analysis. There are various tools that can help with that. Thanks for sharing a great article.

Yes, true, but when you do not have a research team to do the heavy Fundamental Analysis, a combination of Fundamentals and Technicals like in this article helps…

It’s important to get details on a company’s revenue source and segment.

Revenue source could be one of the biggest factors in determining whether a company can be part of your multi-bagger picks.

Yes, it can definitely help!