Market Capitalization (or Market Cap in short) is one of the most important Fundamental parameters used to value any company. Market capitalization is the value of a company determined by multiplying the current market price of one share of the company by the total number of outstanding shares. Since it defines the actual value of the company, it is basically the price an acquiring company would have to pay if it had to buy the company. Of course the exact price depends on the market conditions and usually an acquiring company will pay a lot more than the Market Capitalization.

How to calculate Market Capitalization?

Market Capitalization can be calculated by this simple formula:

Market Capitalization = Current Market Price x Outstanding Shares

e.g. let’s say a company’s current price is Rs 100, and it has 1,00,000 outstanding shares. Then the market capitalization of the company would be:

Market Capitalization = 100 x 1,00,000 = Rs 1,00,00,000 or Rs 1 cr.

How to use Market Capitalization for investing?

Market Cap can be used by long-term investors to decide on whether they should be investing in the company at all. Some companies are so small, and prone to manipulation by the operators, hence it is best for any investor because it may have such less valuation for a good reason. Even for short-term swing traders or intraday traders, it is a good idea to stay away from them, because the stocks with low market cap are more prone to failure will be more prone to false signals.

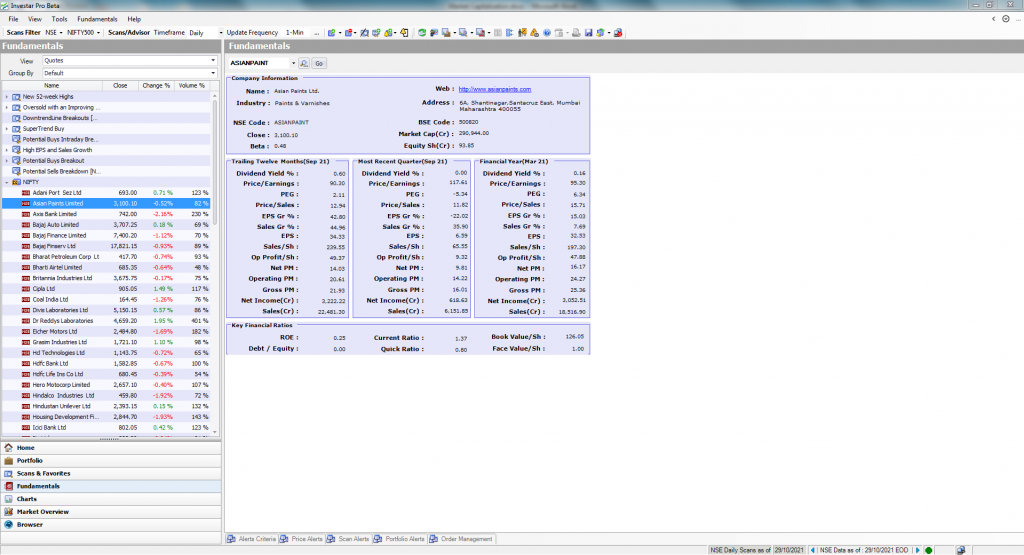

Market Cap is displayed when you go to the Fundamentals Pane and then click on any stock in your watchlists or scans, as shown below:

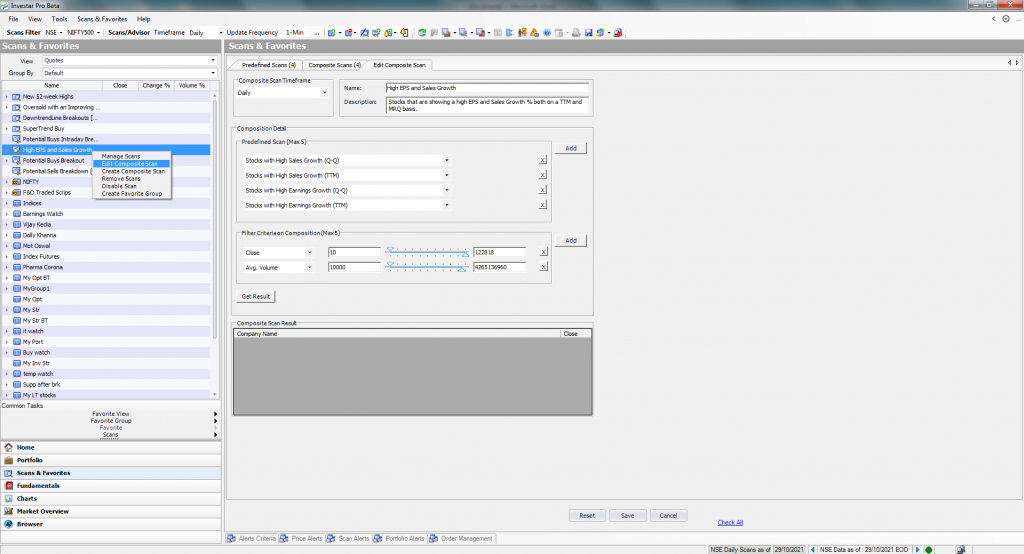

A good filter to apply for Market Capitalization is to ignore all stocks below Rs 100 cr (for example). You can create this kind of a scan easily with the use of a Composite Scan. E.g. One of the default Composite scan that ships with the software is the “High EPS and Sales Growth” scan, which you can get when you right click on it and select “Edit Composite Scan” as follows:

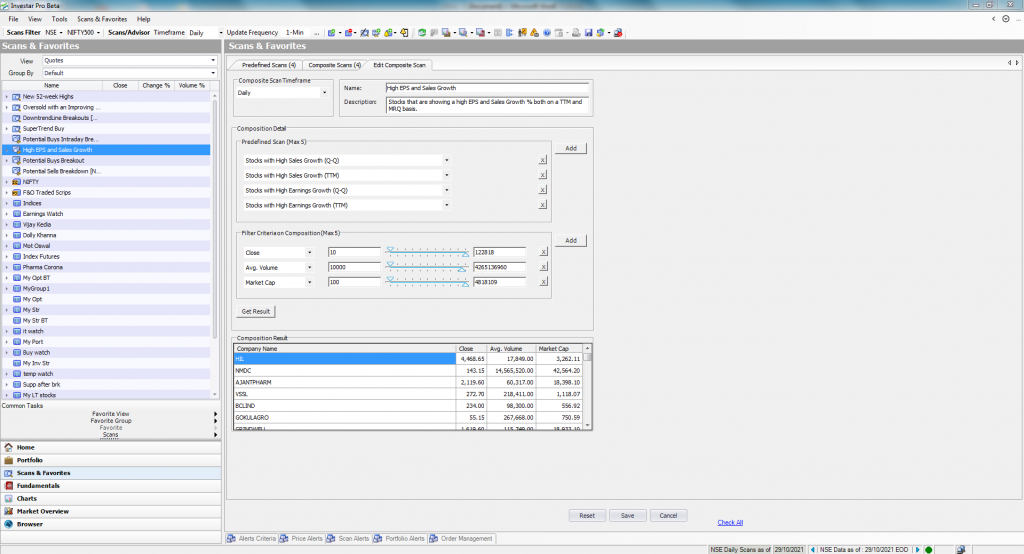

Let’s apply a market cap filter to this by adding a Filter Condition. Click on the “Add” button and then add the Market Cap condition as follows:

Now if we click on “Get Result” we will see this additional Market Capitalization applied to the Composite Scan and we will only get Stocks which are above Rs 100 Cr. Once you click on “Save”, this new Composite Scan is saved and the results displayed on the left in the Navigation Pane.

Market Capitalization does not give a true picture at times, especially if a company has a lot of debt on its books. In a future blog post, we will understand another important measure of value called “Enterprise Value”, which is used a lot by value investors.