In this blog, we will see how Investar software identified a short term Multibagger stocks- 2019, using a multi-timeframe volume breakout which went up by almost 50% even when Nifty was in severe correction mode last week.

You will also learn how to identify such stocks when to enter and exit the stock and how to find such stock in the futures by using an example of Hathway Limited.

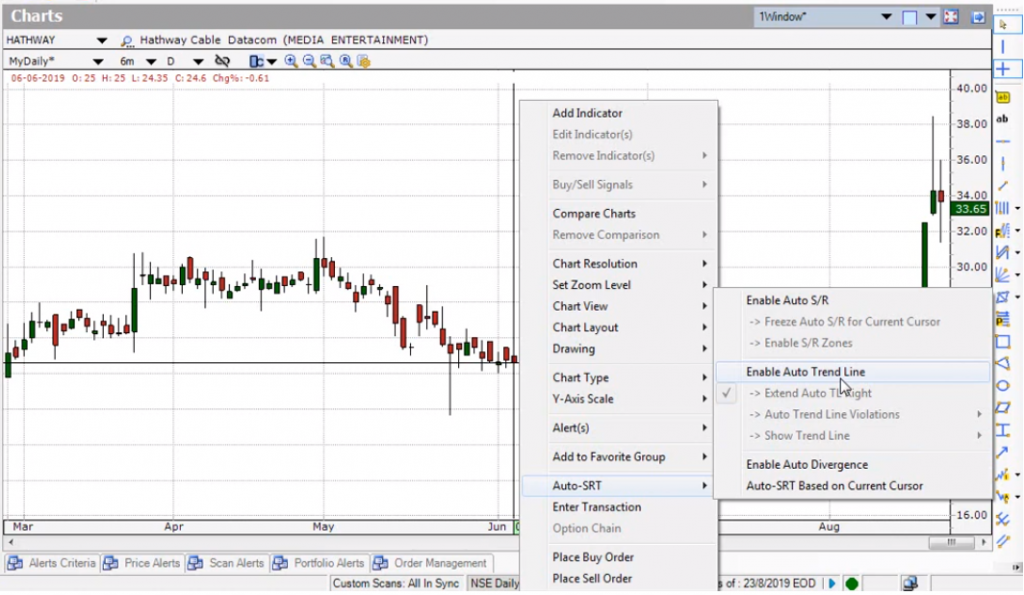

Above is the chart of Hathway Limited which shows a gain of almost 50% when the Nifty corrected by 2.2% last week. What we have to do is to check how we can use Technical Analysis to identify such stock. For that, we will simply use our Auto Trendline feature.

To enable Auto Trendline, simply right click on the Chart in Investar software and click Enable Auto Trend Line as shown below.

As you can clearly see in the above Daily time frame chart there was a downtrend line breakout on 13th Aug 2019 which was indicating a possible trend reversal. We can be sure only with this condition as Investar uses Automatic Trendlines for Trend Analysis (powered by AI) but we will also try to put some other condition and check if this stock satisfies those conditions or not.

Always keep in mind that whenever a stock makes breakout from downtrend line or from a supply zone, volume plays a very important role. If we add the Volume indicator and its SMA(50) on this chart, we can see that, we can clearly see that when this stock made a breakout i.e. 13th Aug 2019, the volume was very high (it was almost 6x higher compared to average volume).

Now, to complete our Multi-timeframe Volume Breakout Strategy, we will use a 75-min Timeframe and 2 window layout to see the difference and identify other conditions.

As you can see in 75-min timeframe there was a clear zone breakout at 10:30 am on 13th Aug 2019, with a very strong supply zone (green colored) on the very first candle along with 15x volume compare to average volume.

Hence, our Multi-timeframe Volume Breakout Strategy can be summarized as:

- Breakout of the downtrend line on high volume in a Daily chart

- Breakout of supply zone (i.e. resistance zone) on high volume in a 75-min timeframe.

Now, let us see how to exit from this stock, for that we will use the Investar Pre-defined custom scan “RSI followed by supertrend–Sell” which comes inbuilt in the software. This is a custom scan as described in this blog post.

You can see that we got the sell signal on 23rd Aug 2019 where RSI(7) Sell was followed by Supertrend(5,1.5) Sell also. So our total gain from zone breakout to Sell signal is around 52.47% which as you know is very difficult during a market which is going down the way Nifty did last week.

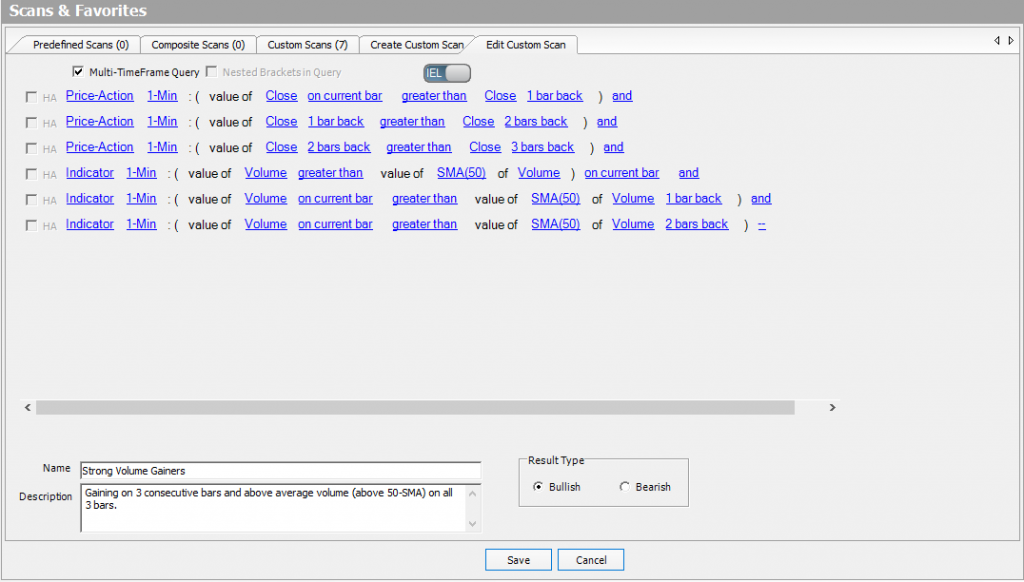

How to scan for short-term Multibaggers using Multi-timeframe Strategy

We will create a multi-timeframe scan which helps us to find such Multibagger stocks. Simply click on Create Custom Scan in Investar Software and check the “Multi-Timeframe Query” box.

Once the scan is saved, all you have to do is to select “Multi-TF” from Time frame Dropdown box in the Menu bar and you can see the selected Multi-TF scan appear in the navigation pane within split seconds as shown in the chart below :

And if you want you can also set alert(s) on these scans.

Right-click on the desired scrip name in a Scan or a Favorite Group and select Set Scan Alert.

Then simply, select the Multi TF from the Scan Type drop-down in the Alert Criteria Dialog Box.

For more details, check out our video on “Multibagger Stock Strategy | Multi-timeframe Volume Breakout Strategy for identifying Multibaggers” for an in-depth look into this topic :

We hope this post has given you some new ideas on how to identify a short term Multibagger stocks for 2019 using a Multi timeframe Volume Breakout Strategy.

How to use

Please contact our Support:+91-97250-10402 team we will walk you through…

Good.

Thank you

How to identify MTF breakout in Android app?

You have to create MTF breakout scan in investar software and you will get a scan alert notification in the Android app. Also, you can contact our Support:+91-97250-10402 team for more details.