If you use Technical Analysis on any active Future, you must have faced the problem regarding insufficient historical data. That’s because futures have very limited history (usually a maximum of 3 months), which make doing any worthwhile Technical Analysis extremely difficult. In order to solve this problem, Technical Analysts have come up with a few ways to perform the analysis.

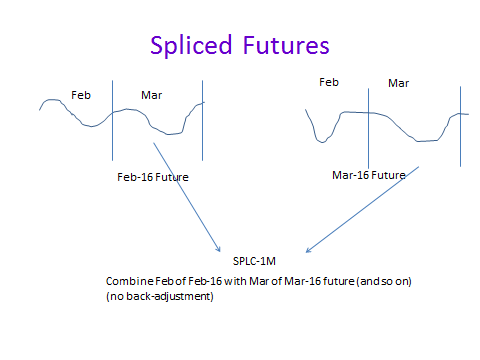

The best way is to concatenate the Future prices to come up with a futures chart that is “continuous”. This is called a spliced future and a majority of the software in the Indian market provide only this kind of chart as it is easy to use. Most charting vendors provide a simple concatenation of historical prices called a spliced future as depicted in the slide below:

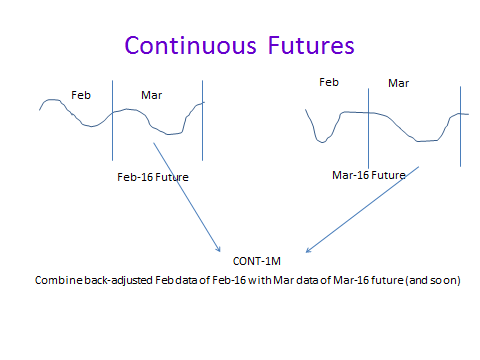

However, in reality what happens is that there is invariably a discontinuity caused by “concatenating” different future expiries (as they have different premiums) that would make your Technical Analysis inaccurate. This has been explained in a very good article, Continous Contracts Explained. In Investar, what we do is we also provide a continuous future where all the previous data is back-adjusted to close the gaps. This is done by taking the closing price of the expiring future and the closing price of the next month future and taking the difference to back-adjust all previous data accordingly.

To see this in action, here is a screenshot of Investar with a 3-chart layout showing Mar-16 future and SPLC-1M and CONT-1M of NIFTY:

The closing prices of the Feb-16 future on the day of expiry (25-Feb16) are as follows:

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2016-02-25 | 7015.00 | 7030.00 | 6961.30 | 6968.50 |

The closing prices of the Mar-16 future on the day of expiry (25-Feb16) are as follows:

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2016-02-25 | 7045.15 | 7058.60 | 6987.15 | 7001.10 |

The difference in the closing price between the Feb-16 and Mar-16 future on the expiry date is as follows:

7001.1 (Mar-16 Future) – 6968.5 (Feb-16 Future) = 32.6

As can be seen in the screenshot, the NIFTY-SPLC-1M future OHLC values on 25-Feb, 2016 are exactly the same as that of the Feb-16 future, while for the NIFTY-CONT-1M, only closing price is matching that of the Mar-16 future. This is because when back-adjusting we adjust this difference of 32.6 (for closing the discontinuity or ‘gap’) to derive the OHLC values for 25-Feb, 2016 for NIFTY-CONT-1M as follows:

Open: 7015 + 32.6 = 7047.6

High: 7030 + 32.6 = 7062.6

Low: 6961.3 + 32.6 = 6993.9

Close: 6968.5 + 32.6 = 7001.1

As you can see, these OHLC values are matching the OHLC values for 23-Feb, 2016 for NIFTY-CONT-1M.

This has to be done for all the previous prices to ensure that we back-adjust appropriately. As can be seen, it’s a tedious task, but Investar does that for you automatically while most other software for the Indian market only give you the spliced futures (and also incorrectly call them continuous futures!).

So, when should you use Continuous Futures?

Almost any Technical Analysis should be done on Continuous Futures, because it will be more accurate. About the only time you should be using Spliced Futures will be when you want to find out if the stock future went above a previous high/low, and when you want to look at actual prices for all past series for a future.

Nice Article