In this blog post, we will explore the use of Harmonic Patterns in Intraday Option Buying.

What are Harmonic Patterns?

- Harmonic Patterns utilize Fibonacci ratios to define precise turning points

- Harmonic Trading attempts to predict future price movements based on specified Fibonacci retracements forming an XABCD pattern or ABCD pattern.

In case, you are not familiar with Harmonic Patterns, and want to go into them in detail, you can go through them in more details in this blog post.

How to Use Harmonic Patterns in Intraday Option Trading?

Here are the steps you can follow to use Harmonic Patterns effectively in your intraday option trading strategies:

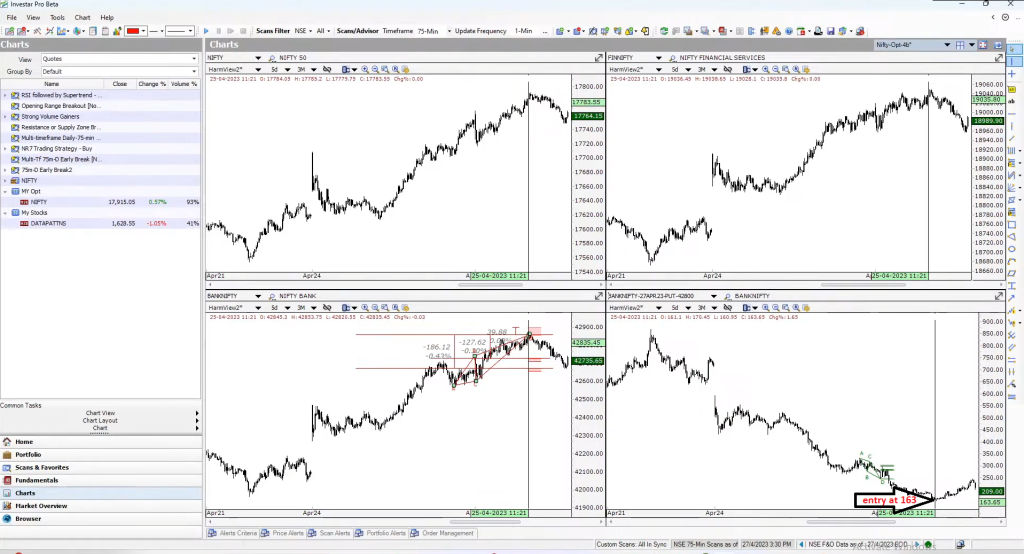

Harmonic Patterns can be used in Intraday Options Trading as they define clear reversal points and also the risk is clearly defined. Lets show this with an example. If we enable “Auto-Harmonic Patterns” in Investar, and also “Auto-Harmonic Patterns based on current cursor”, then we can see the Harmonic Patterns formed where our cursor is located (this is just to show the strategy), as shown below:

As can be seen in the chart above, the Harmonic Pattern is a bearish Alter ABCD pattern, and indicates a possible reversal at the D point (the shaded red area at the peak in the price chart). Our risk is defined as the height of the D point and is 40 points approx. and the reward is the height of the first PR Zone from the D point which is 127 points. Hence the reward to risk ratio is 127/40 = almost 3, which gives us a very favorable trade.

So, having seen this pattern in the Nifty chart, now how do you trade the option?

To see this let’s pull up a 4 window layout in Investar, and in the screenshot below, the bottom right chart has the ATM BANKNIFTY option. When If we see the price on that, our entry would be at 163.

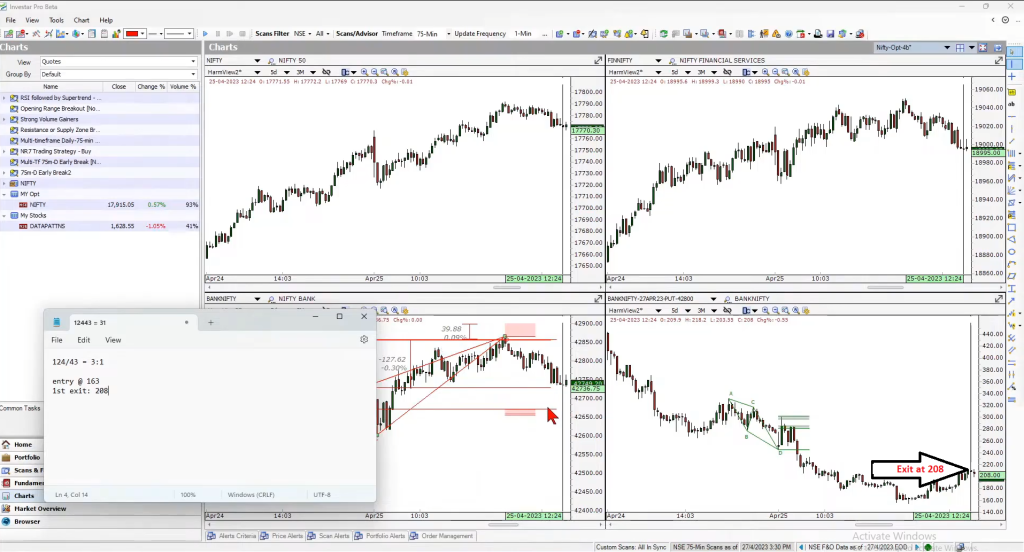

The below chart shows the exit price when the first PR Zone is hit, and it is 208.

Hence our reward would be 208-163 = 45 points in this intraday trade.

We can summarize our Harmonic Pattern Intraday Option Strategy as follows:

- Find out where Strong Harmonic Patterns are forming.

- Risk = Height of PR Zone at D Point

- Reward = 1st PR Zone after the reversal.

- Reward to Risk should be > 2.

Advantages of Using Harmonic Patterns in Intraday Option Trading:

Using Harmonic Patterns in intraday option trading can offer several advantages, including:

Identifying potential trade opportunities: Harmonic Patterns can help traders identify potential trade opportunities based on market trends and predict future price movements. This can help traders make informed decisions and enter trades at the right time.

Minimizing potential losses: Setting stop-loss orders based on Harmonic Patterns can help traders minimize potential losses. By following this approach, traders can minimize the risk of substantial losses and preserve their capital.

Improving trading strategies: Harmonic Patterns can help traders improve their trading strategies by providing them with a more comprehensive understanding of the market. This can help traders make better trading decisions and achieve better results.

If you want to see this strategy in more detail, see this video: