In this blog post, we will explore the importance of analyzing your trades as a trader or investor. By conducting postmortem analysis of your investments and trades, you can become a better trader and make informed decisions.

We will use Investar software to demonstrate how to import transactions into the Portfolio Manager and track your trades effectively.

To begin, we need to import the transactions from our trading account into the portfolio manager. We download the trade book from our trading platform, making sure to format it for easy import.

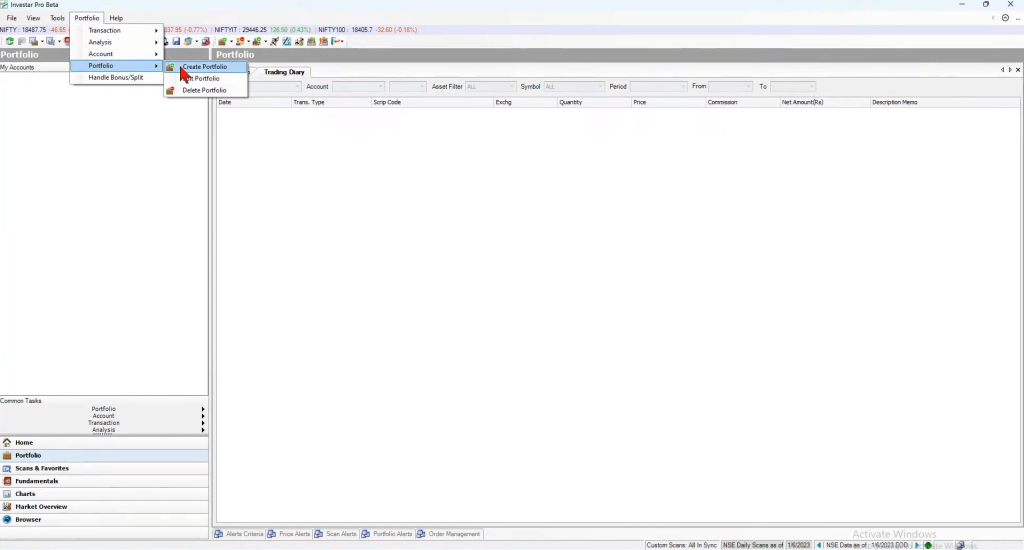

Create Portfolio Account

In the software, we first create a portfolio, which allows us to track our trades and analyze our performance.Additionally, we create an account, to organize our trades based on the broker or trading platform used.We input the starting date and the initial capital invested in the account.

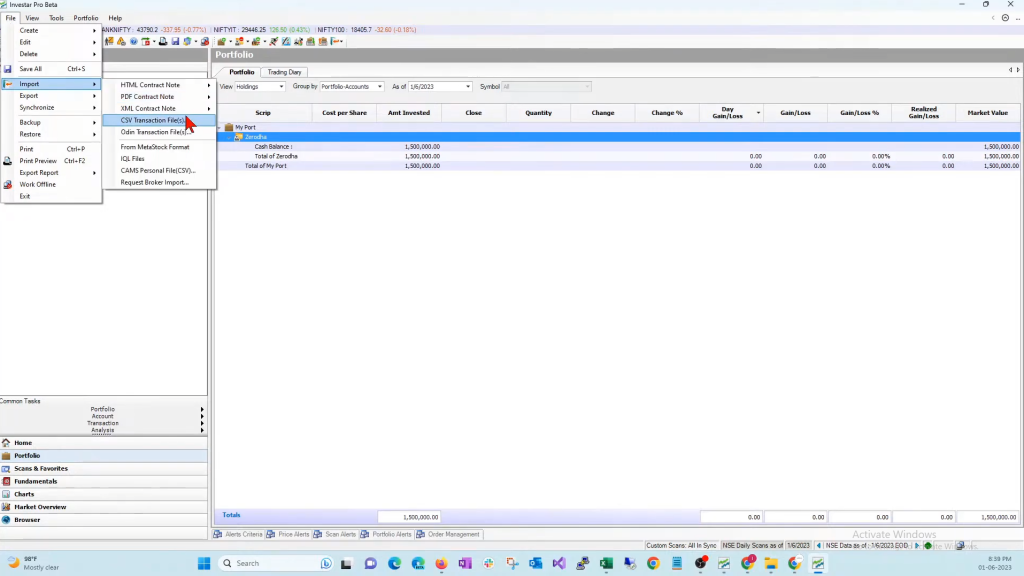

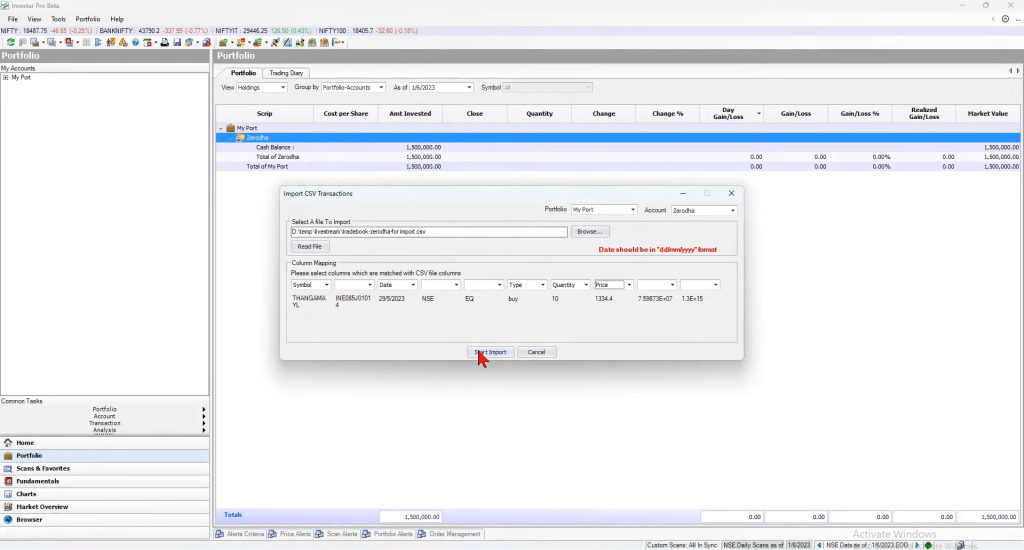

Import Transactions

Next, we import the transactions into the Portfolio Manager. Using the software’s functionality, we browse and select the CSV transaction file downloaded from our trading platform.

The software maps the columns in the file to the appropriate elements, such as symbols, dates, transaction types, prices, and quantities. After confirming the import, all transactions are automatically added to the portfolio within seconds.

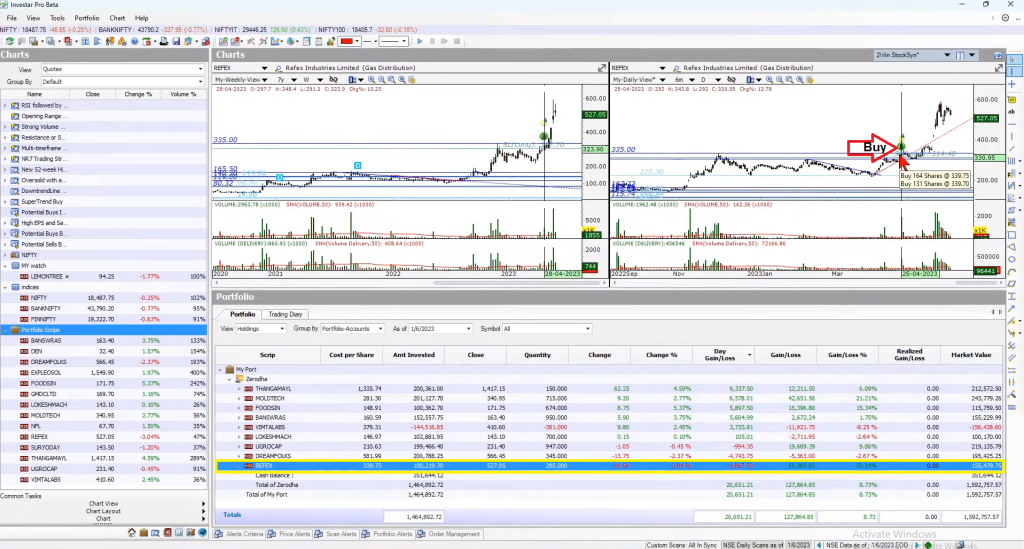

Analyzing Trades

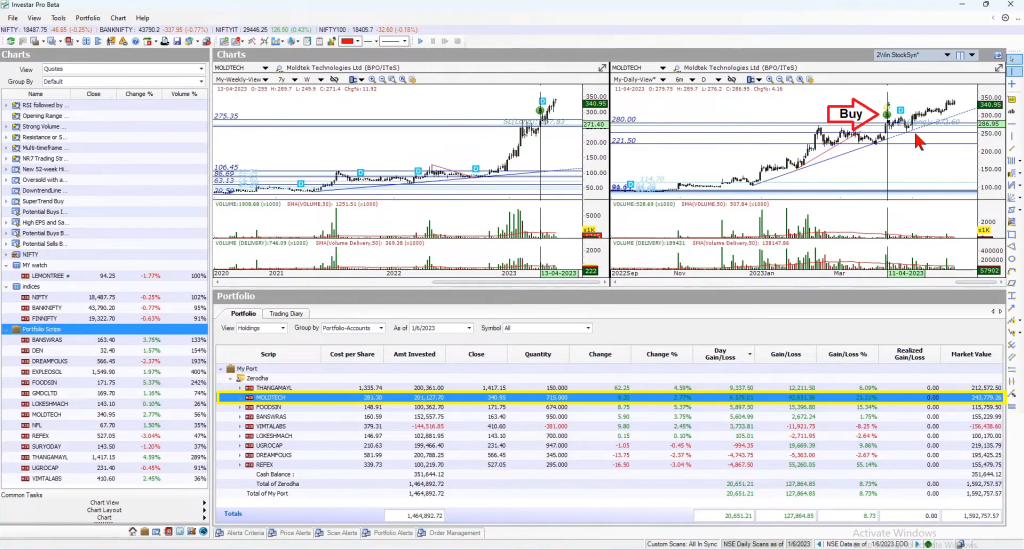

Once the transactions are imported, we can analyze our trades and their outcomes.We navigate to the portfolio manager and view Portfolio and Charts together by clicking the “Portfolio with Charts” button (as shown in screenshot below) and observe the gain or loss associated with each trade.

We can also view the current holdings and the stocks we have sold.By reviewing the charts alongside the portfolio, we can also see the actual Buy and Sell dates (green and red symbols in the chart). With this, we can gain insights into the timing and performance of our trades.

Trade Examples

We examine several trade examples to illustrate the analysis process. For instance, a trade on a stock called REFEX shows a significant gain due to a volume breakout and adherence to a support level.

Another stock, MoldTech experienced a sideways movement before rallying, while maintaining its support trendline.

Analyzing your trades is a crucial aspect of becoming a successful trader or investor.By importing and tracking your transactions using portfolio management software like Investar, you can gain insights into your trading performance.

By using the Portfolio with Charts Feature, we can understand the significance of reviewing volume patterns, support and resistance levels, and fundamental indicators to make informed trading decisions.

Examine trade examples considering fundamental factors (when required) contribute to making informed decisions and improving your trading skills.

If you want to see this strategy in more detail, see this video: