In our previous post, we had seen that a Bear Market has started. So the question is how does one make money in a Bear Market where most of the stocks are heading down. In this post, we will look at two Bank Nifty Option Trading Strategies using Auto-Support/Resistance, Auto-Supply/Demand Zones and Auto-Trendlines, one based on CALLs and another based on PUTs.

In a Bear Market, one should generally look for shorting opportunities when there are short rallies, and there was one that came up last week.

To find out more about how we could come up with a BankNifty Option Trading Strategy for shorting, let’s enable Auto-Support/Resistance, Auto-Trendlines and Auto-Supply/Demand Zones and when you do that, we can see that Investar plots the Support/Resistance, Trendlines and Supply/Demand Zones automatically using Artificial Intelligence.

As can be seen in the chart below, the blue trendline indicates an uptrend from 30th March 15:00, and the uptrend ended when the blue trendline broke at 31st March 15:15. This break of uptrend can be used as a Sell signal to go short on the Bank Nifty.

As can also be seen, in the chart above, the volume was also above average for 2 continuous bars when the breakdown happened and we also had an overhead resistance due to a supply zone above (19638-19460).

So what are the Bank Nifty Option Trading strategies we can adopt for going short?

- Buy a Bank Nifty Put

- Sell a Bank Nifty Call

But how do we decide the Strike Price for the Option. The lower resistance of the Supply Zone can help us decide the Strike Price of Bank Nifty Option to trade. To do that, we have to understand that a Call should be sold where you expect the resistance to be there, and since the lower level of Supply Zone is at 19460, we can choose the Strike Price slightly above at 19500 (to be on the safer side). For the sake of comparison, we will also use the same strike price of 19500 for buying a Put.

To understand the exact entry point for this Bank Nifty Option Trading Strategy, let’s look at a 3-window layout in Investar where the Bank Nifty Future, Put and Call are shown as shown below. As you can see when the blue trendline broke in the BankNifty Future chart (BANKNIFTY-CONT-1M), the Put price at 3:15 pm was 656, and it so happened that it also broke out of a downtrend.

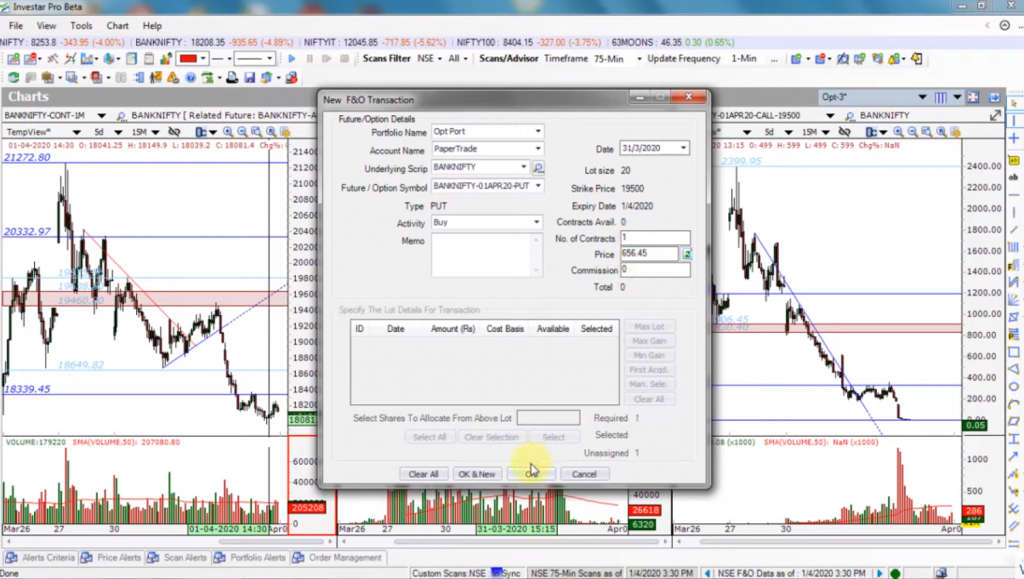

We can paper trade this by simply right-clicking on the Chart and selecting “Enter Portfolio Transaction” and the details of the transaction are automatically entered as shown below.

We can do a similar thing and paper trade Selling a Call at the same time, and we can compare the results of the two strategies in the Portfolio Manager.

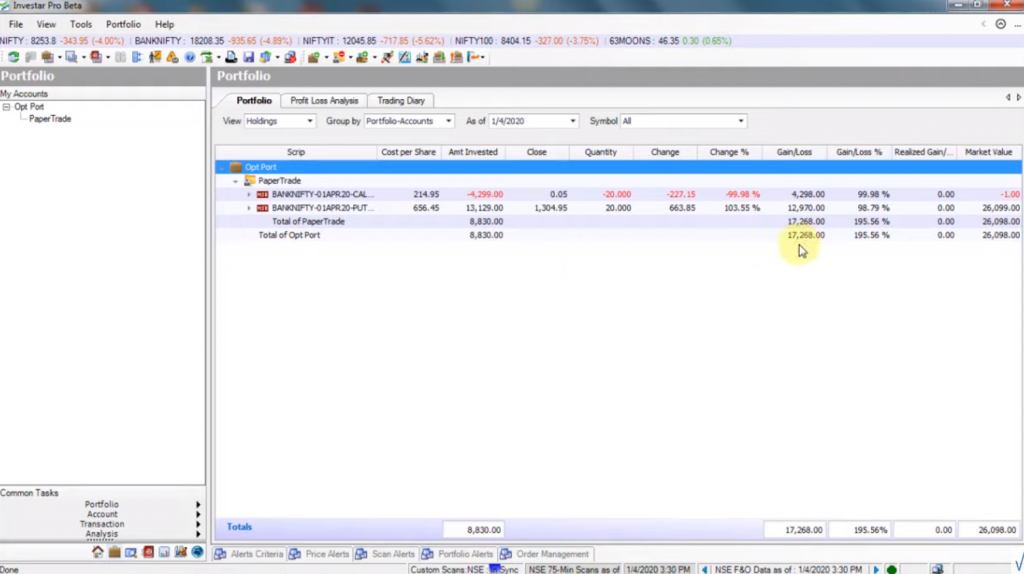

As can be seen in the screenshot above, buying a Put gave us much more gain compared to selling a Call but it is more riskier to buy a Put compared to selling a Call, since if the price did not move much, we would be losing the premium due to Theta decay. Selling a Call does have higher margin requirements and hence requires more capital though.

We hope you learnt some concepts on how you can go short using two possible Bank Nifty Trading Strategies as described in the post. For more details about these Bank Nifty Trading Strategies, please see this video:

Want to try out this Bank Nifty Option Trading Strategy?

Click on the button below to download a Free 7-day trial of Investar: