In this blog post, we will explore the concept of multiple timeframe trading and how it can help increase profits.

We will discuss the different timeframes suitable for various types of trading and delve into real examples to illustrate the application of this strategy.

Understanding Multiple Timeframe Trading

Multiple timeframe trading involves using at least two timeframes to analyze and make trading decisions.Typically, a lower timeframe is used for entries and exits, while a higher timeframe is used to confirm signals.By utilizing multiple timeframes, traders can minimize false signals and increase the likelihood of profitable trades.

Choosing the Right Timeframes

The first step in multiple timeframe trading is to choose the right timeframes. The choice of timeframes depends on the trader’s holding period and trading style.

- Long-term investors may use Daily and Weekly charts.

- Short-term traders can benefit from a combination of Daily and 75-minute charts (In the Indian market, 75-min is a great option instead of hourly because there are exactly five 75-min candles in a day)

- Intraday traders often employ 30-minute and 5-minute or 15-minute and 3-minute timeframes.

The key is to ensure that the selected timeframes are separated by a factor of 4 to 6.

Confirming Signals with Multiple Timeframes

When using multiple timeframes, it is crucial to confirm signals across different timeframes.For instance, if a buy signal is identified on a lower timeframe, it should be validated by a corresponding strong signal on the higher timeframe. Confirmation across timeframes strengthens the reliability of the signal and increases the potential for higher profits.

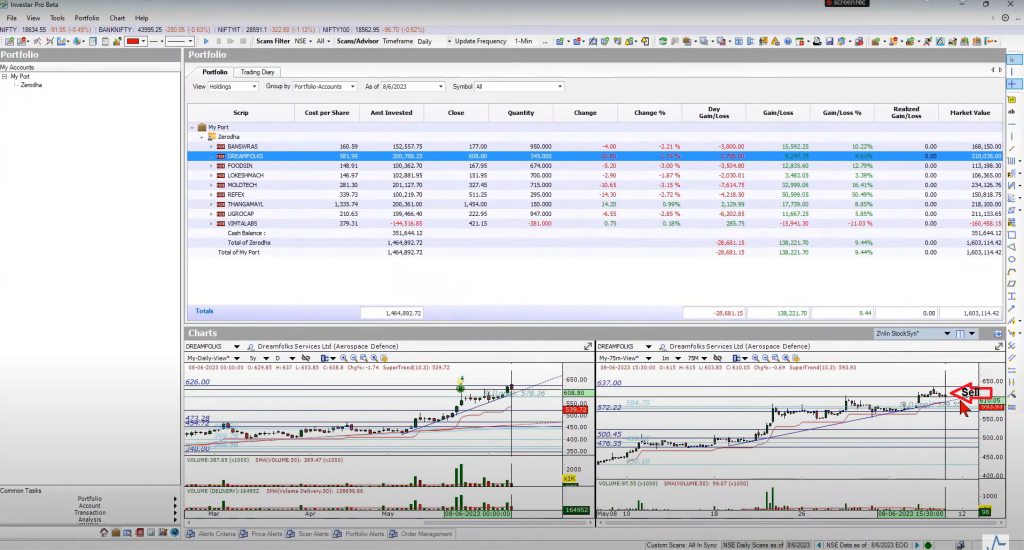

Real Example

To illustrate the application of multiple timeframe trading, let’s examine a real example. TBZ Ltd was identified through a multi-timeframe scan for a daily and 75-minute volume breakout.The breakout occurred in the first 75-minute bar, indicating a potential entry point.

By entering early, traders gain an advantage, as the stock might already be extended by the time the daily chart confirms the breakout.

Optimizing Exits with Multiple Timeframes

Multiple timeframes can also aid in determining optimal exit points. For instance, traders can combine trendline breakdowns, support breakdowns, and other confirming signals from lower timeframes to identify favorable exit opportunities.

Relying solely on trendline breaks on a daily chart may not provide sufficient confirmation. Incorporating multiple timeframes into trading strategies can enhance decision-making and increase profitability.

By using a lower timeframe for entries and exits and confirming signals with a higher timeframe, traders can minimize false signals and capture stronger trade opportunities.

It is essential to select appropriate timeframes based on trading style and holding period, ensuring a sufficient separation between them.

Real examples highlight the practical application of this strategy and its potential for improved trading outcomes.

If you want to see this strategy in more detail, see this video: