Introduction

Welcome, fellow traders and enthusiasts of the financial world! Today, we’re diving into the exciting realm of Momentum Trading, an approach that seeks to capitalize on short-term price movements in the market. If you’re someone who’s intrigued by the art of technical analysis and the thrill of active trading, this blog post is tailor-made for you. Let’s explore the ins and outs of Short-Term Momentum Trading and learn effective strategies to boost your trading game!

Understanding Momentum Trading

Before we jump into the nitty-gritty, let’s get on the same page about what Momentum Trading is all about. At its core, it’s a trading strategy that focuses on identifying and riding the wave of strong price movements in the market. The idea is simple yet powerful: once a stock or asset starts moving in a particular direction, it tends to keep moving in that direction for a while.

Why Momentum Trading Works

Momentum Trading is based on the principle of market psychology and human behavior. When a stock shows rapid price movements, it attracts attention from traders and investors. The fear of missing out (FOMO) prompts more market participants to jump on board, further fueling the price momentum.

Key Principles of Short-Term Momentum Trading

To make the most of your momentum trading strategy, keep these fundamental principles in mind:

Identify Strong Trends: Look for assets that are experiencing clear and strong trends in either direction. Utilize technical analysis tools like moving averages, MACD, and RSI to spot these trends.

Volume Confirmation: Confirm the validity of price movements with volume analysis. A surge in trading volume accompanying a price movement adds credibility to the momentum.

Risk Management: Set stop-loss orders to protect your capital from sudden reversals. Momentum trading can be volatile, and it’s essential to have a well-defined risk management plan.

Avoid Overtrading: Don’t get carried away by the excitement of fast-paced trading. Stick to your strategy and avoid overtrading, as it can lead to unnecessary losses.

Effective Strategies for Short-Term Momentum Trading

Now that we have the groundwork laid, let’s explore some powerful strategies to enhance your short-term momentum trading approach:

1. Breakout Trading Strategy

Support and Resistance levels are essential in breakout trading. Investar software provides you with AI-powered auto Support/Resistance. It uses Artificial Intelligence (AI) to automatically plot the support/resistance levels and rate them based on the strength of different levels to perform analysis just as an expert Technical Analyst.

The breakout strategy involves identifying key price levels, often support or resistance, and initiating a trade when the price breaks above resistance or below support.

A breakout stock is a share that surpasses its support or resistance level, indicating that it may be on the verge of a significant move. This key concept in technical analysis is known as a breakout. If a stock exceeds its resistance level, it is likely to continue rising, while if it falls below its support level, it may enter a bearish trend.

Support and resistance levels are considered more robust if a stock touches them repeatedly, and stocks that break through these stronger levels often experience substantial price movements.

This breakout can signal the start of a strong trend, providing an excellent opportunity to rid the momentum.

Example: Polycab – 75min Time Frame

2. Relative Strength Index (RSI) Strategy

The Relative Strength Index (RSI) is popular momentum indicator strategy. It is an oscillator that measures the speed and magnitude of price changes. The RSI oscillates between zero and 100, with 50 being neutral.

Overbought conditions: When the RSI is above 70, it is considered overbought. This means that the asset has been rising too quickly and is likely to reverse course soon.

Oversold conditions: When the RSI is below 30, it is considered oversold. This means that the asset has been falling too quickly and is likely to reverse course soon.

Buying signals: Traders often use RSI to identify buying signals. A buy signal is generated when the RSI crosses above 50 from below. This indicates that the asset is moving into an uptrend.

Selling signals: Traders also use RSI to identify selling signals. A sell signal is generated when the RSI crosses below 50 from above. This indicates that the asset is moving into a downtrend.

Example: Adani Enterprises – 30min Time Frame

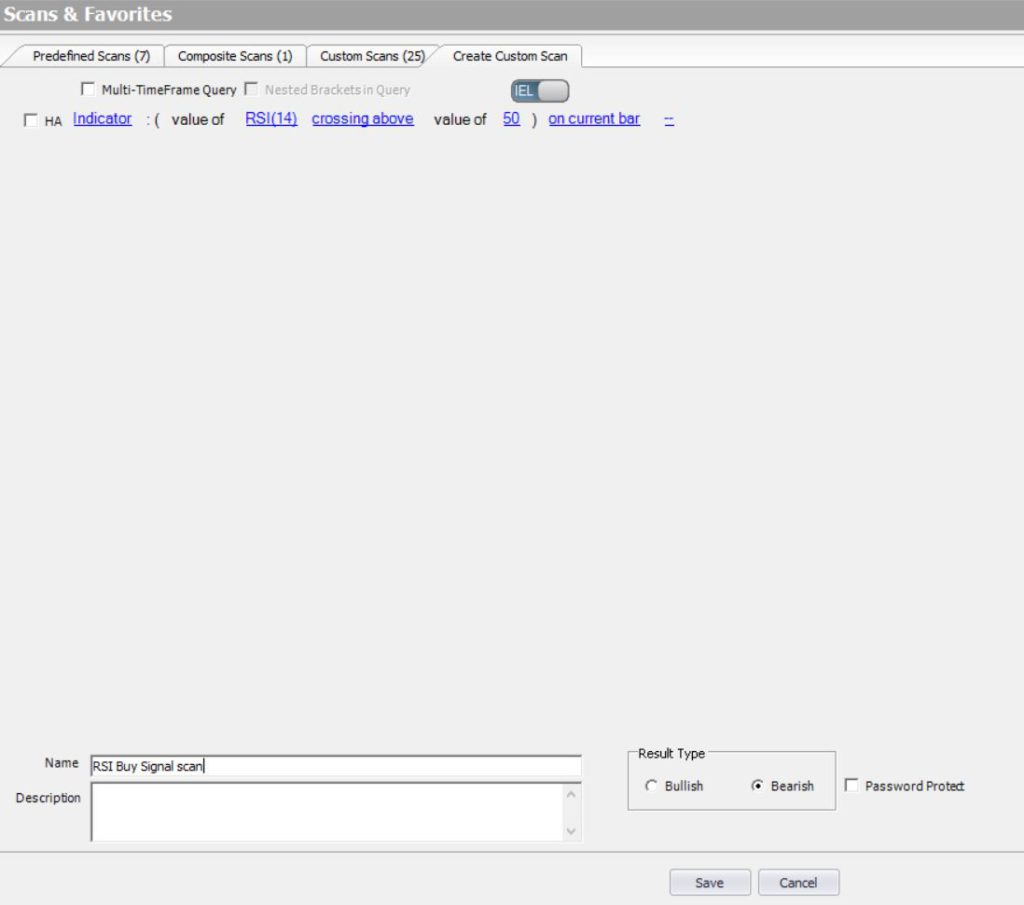

You can also create a custom scan for the RSI strategy, as shown below.

3. Moving Average Crossovers Strategy

This strategy utilizes the crossover of two moving averages to generate trade signals. A potential uptrend is indicated when a shorter-term moving average crosses above a longer-term moving average, while a potential downtrend is indicated when the opposite occurs. This means that when the shorter-term moving average moves below the longer-term moving average, it may signal a downward trend in the market.

Example: Nifty – Daily Time Frame

Conclusion

In conclusion, Short-Term Momentum Trading can be a thrilling and rewarding experience for traders who enjoy the dynamic nature of the market. By understanding the core principles and employing effective strategies like breakout trading, RSI, moving average crossovers, you can enhance your trading prowess and seize opportunities in the ever-changing financial landscape.

Try Investar Technical Analysis software for free and let its helpful assistance enhance your trading journey. Remember, successful momentum trading requires patience, discipline, and constant learning. So, practice with caution, adapt your strategies to the current market conditions, and never stop expanding your knowledge.