What is Cup and Handle Pattern?

Cup and Handle Pattern is a Classical Pattern which resembles a cup with handle, where the cup is in the shape of a ‘U’ or a rounding bottom and the handle is a price channel or triangle pattern drifting downward.

Cup and Handle Pattern was defined by William O’ Neil, in his book, “How to make Money in Stocks” and gave precise requirements on how to trade it in a series of articles published in “Investor’s Business Daily”, a newspaper which he founded.

A Cup and Handle Pattern is considered to be a bullish continuation pattern which is used to indentify bullish breakouts. A Cup and Handle Pattern has the following constituents:

Cup: The Cup in the Cup with Handle is a rounded bottom and looks like a ‘U’. The cup should be of 2 to 6 month long, no longer then 9 months. The longer it is the better it is. The Cup should ideally not be very deep, and also not be sharp and shaped like a ‘V’.

Handle: The handle can be a descending price channel (a bullish continuation pattern) or a pennant or a triangle formation. However, it should be restricted to the top half of the pattern and not be too dee. Ideally the handle should be formed on declining volume, indicating the weak holders exiting, before a stock makes a big move.

How to trade the Cup and Handle Pattern?

The entry point for the Cup and Handle Pattern is usually the breakout of the upward trendline in the price channel or pennant or triangle that is forming the handle. This breakout should ideally happen on a very strong volume (i.e. volume should be much higher than the 50-bar average volume; in Investar, the Vol% should be > 100)

The target is usually the distance between the breakout point handle and the bottom of the cup projected upwards from the handle breakout point.

The stop loss can be placed below the handle or below the cup, based on your risk tolerance, but usually if you want a good risk/reward ratio, placing a stop below the handle is advisable.

What is Inverse Cup and Handle Pattern?

As the name suggest, Inverse Cup and Handle Pattern is a flipped version of Cup and Handle pattern. The cup is in the shape of rounding top and handle is a price channel or triangle pattern drifting upwards.

An Inverse Cup and Handle Pattern is considered to be a bearish continuation pattern which is used to identify bearish breakouts.

How to trade the Inverse Cup and Handle Pattern?

The entry point for the Inverse Cup and Handle Pattern is usually the breakdown of the upward trendline in the price channel or pennant or triangle that is forming the handle. This breakdown should ideally happen on a very strong volume (i.e. volume should be much higher than the 50-bar average volume; in Investar, the Vol% should be > 100)

The target is usually the distance between the breakdown point and the top of the cup projected downwards from the handle breakdown point.

The stop loss can be placed above the handle or above the cup, based on your risk tolerance, but usually if you want a good risk/reward ratio, placing a stop above the handle is advisable.

How to scan for stocks forming a Cup and Handle Pattern?

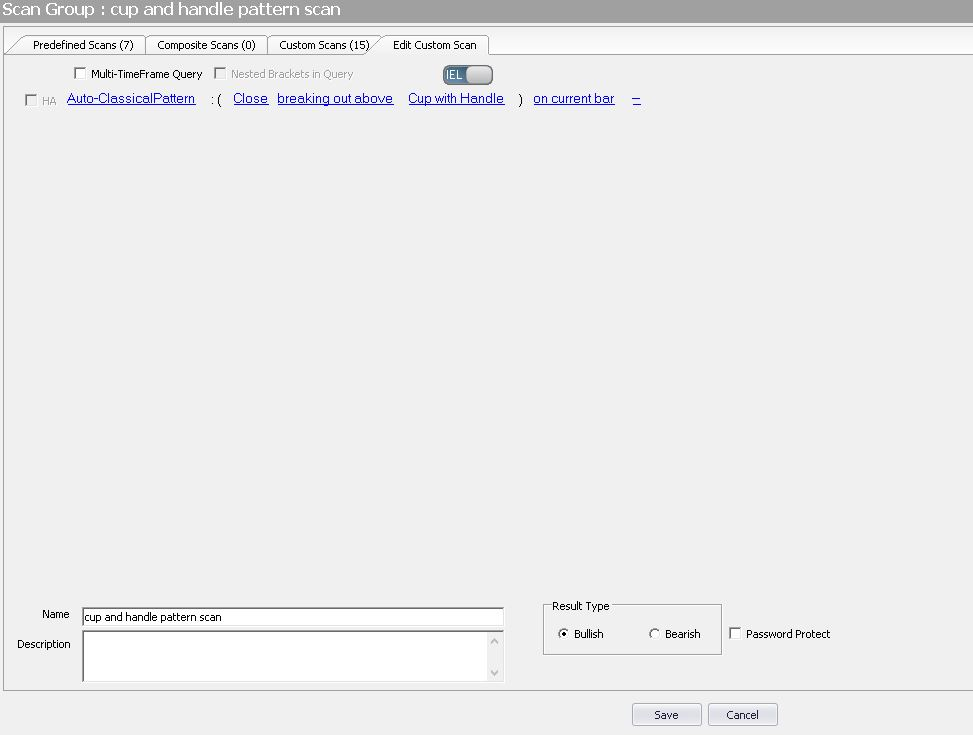

In Investar you can scan for stocks forming a Cup and Handle Pattern with the following custom scan :

Cup and Handle Pattern Scan Query:

Cup and Handle Pattern Scan Result:

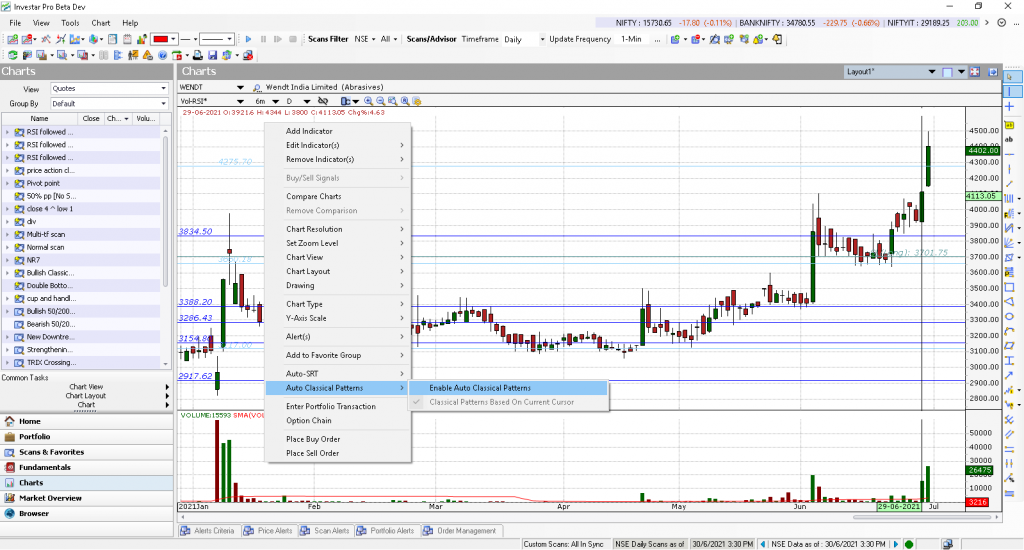

In order to see the Cup and Handle Pattern on the chart, you will also need to enable the Cup and Handle Pattern by right-clicking on the chart and then selecting “Auto-Classical Patterns” and then “Enable Auto Classical Patterns ”.

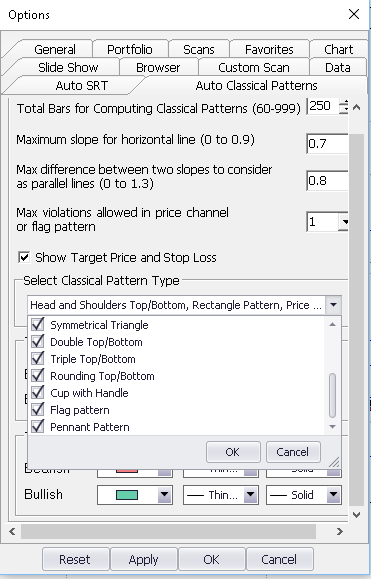

You also need to ensure that Cup and Handle Pattern is selected in the Tools-Options-Auto-Classical Pattern tab .

For more details, check out our video on “Auto-Classical Patterns” for an in-depth look into this topic :