What is Head and Shoulders Pattern?

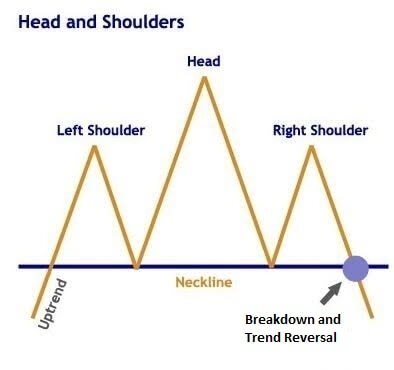

The Head and Shoulders Pattern is one of the most reliable classical patterns in Technical Analysis. Also called a Head and Shoulders Top, it is a bearish pattern that consists of three peaks, with two outside peaks that are about the same height which form the Shoulders and the middle peak that is higher than them that forms the Head of the pattern. The left shoulder is formed when the price goes up in an uptrend and then goes down to form a trough. Then the price rises in an uptrend and rises above the peak of the left shoulder to reach a new high to form the Head. Thereafter the price falls and forms a trough and then rises again but this time it reaches just about the height of the left shoulder and then reverses to complete the right shoulder and hence the Head and Shoulders Pattern.

How to trade the Head and Shoulders Pattern

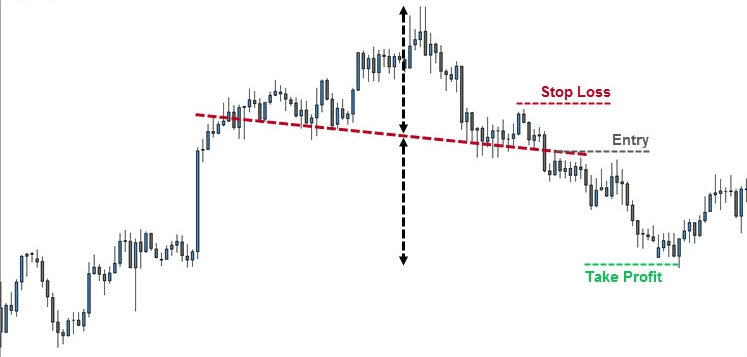

One of the main advantages of the Head and Shoulders Pattern is that it not only gives you the entry but also the target and possible stop loss.

Head and Shoulders Pattern – Entry

A neckline (basically a trendline) is usually drawn through the two lows (troughs) between the Head and Shoulders. It acts as the support line, which when broken indicates that the trend is about to reverse. This trendline should ideally be horizontal or an uptrendline, as a break of it would indicate a start of a downtrend. Traders usually go short when the neckline is broken.

Head and Shoulders Pattern – Target

To find the profit target when you go short on the break of the neckline, you simply take the height of the head above the neckline and then project that price downwards from the point of break of the neckline to find the profit target.

Head and Shoulders Pattern – Stop/Loss

Although you can take the peak of the 2nd shoulder as the stop/loss, this would increase the risk of the trade in case it doesn’t work out. Instead, one can take the neckline to get a tighter stop-loss, because if the price breaks down from the neckline and then rises back above it, then it would end up invalidating the Head and Shoulders Pattern .

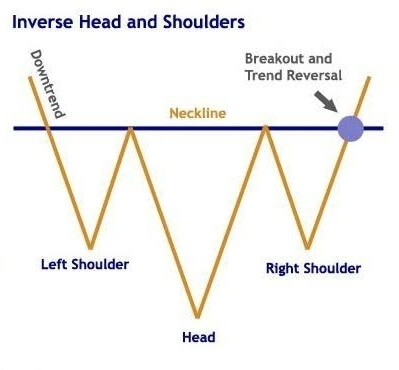

Inverse Head and Shoulders Pattern

The opposite of a head and shoulders pattern is the inverse head and shoulders, also called a head and shoulders bottom.. This pattern is formed when the price meets the following price action criteria that are opposite of the Head and Shoulders Top: price falls to a trough and then rises; the price falls below the former trough and then rises again; finally, the price falls again but not as far as the second trough. Once the final trough is made, the price heads upward, toward the resistance found near the top of the previous troughs .

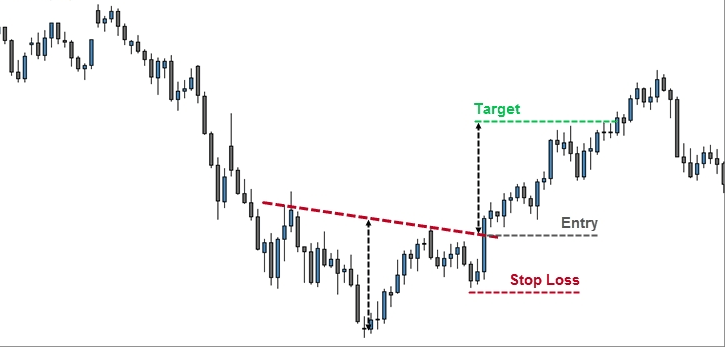

How to trade the Inverse Head and Shoulders Pattern

Like the Head and Shoulders Top above, you can trade the Inverse Head and Shoulders Pattern as follows:

Inverse Head and Shoulders Pattern – Entry

A neckline (basically a trendline) is usually drawn through the two highs (peaks) between the Inverse Head and Shoulders. It acts as the resistance line, which when broken indicates that the trend is about to reverse. This trendline should ideally be horizontal or a downtrendline, as a break of it would indicate a start of an uptrend. Traders usually go long when the neckline is broken on the upside.

Inverse Head and Shoulders Pattern – Target

To find the profit target when you go long on the break of the neckline, you simply take the height of the head below the neckline and then project that price upwards from the point of break of the neckline to find the profit target.

Inverse Head and Shoulders Pattern – Stop/Loss

Although you can take the trough of the 2nd shoulder as the stop/loss, this would increase the risk of the trade in case it doesn’t work out. Instead, one can take the neckline to get a tighter stop-loss, because if the price breaks out of the neckline and then falls back below it, then it would end up invalidating the Inverse Head and Shoulders Pattern.

An example of Head and Shoulders Pattern is shown in the screenshot below.

For more details, check out our video on “Auto-Classical Patterns” for an in-depth look into this topic :

excellent details analysis, the difference of volume between two shoulders is missing

Glad you enjoy it.

Give lessons for intraday

ok

itani achhi janakari ko sajha karane ke liye apana kabut bahut dhanywad

Thank you